44 non cash charitable contributions donations worksheet

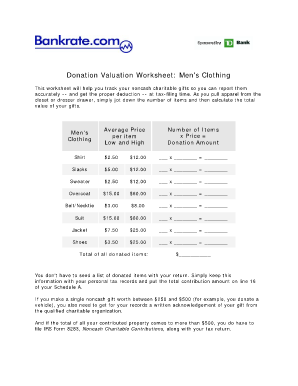

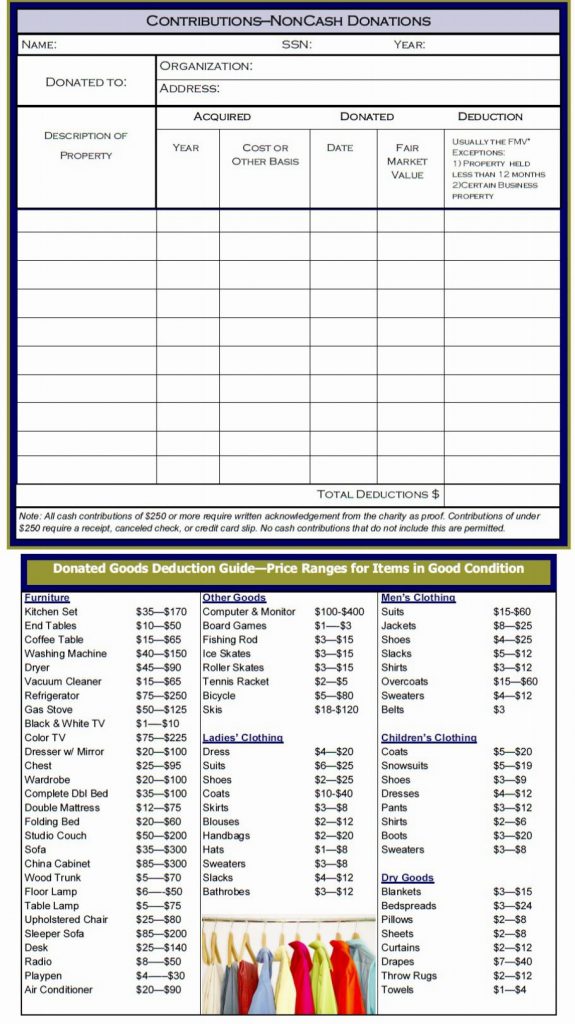

Donation Calculator Therefore, the ideal way to use this spreadsheet is by laptop or desktop computer. Entering Data Enter the number of items you donate in the Qty columns. Also, your totals will reset when you do. However, if when you enter a quantity field, you get an error. Simply change the quantity to 0 (zero). Exporting PDF 2020 Charitable Contributions Noncash FMV Guide - DHA CPAs Charitable contributions of property in excess of $5,000. Planning Tip: Most cell phones today can take pictures. Take a picture of all items donated. Keep the electronic pictures for proof the items were in good or better con-dition at the time they were donated. Recordkeeping Rules for Charitable Contributions

Non Charitable Donations Worksheets - K12 Workbook *Click on Open button to open and print to worksheet. 1. NON-CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET 2. NON-CASH DONATION WORKSHEET (Based on Salvation Army ... 3. Non Cash Charitable Contribution 4. Charitable Donations Worksheets (Non Cash Contributions) 5. Tax e-form Non-Cash Charitable Contribution Worksheet

Non cash charitable contributions donations worksheet

Tax Tip: Deducting Non-Cash Charitable Donations for 2021 In our last article, Deducting Charitable Cash Contributions for 2021, we discussed the proper ways to deduct cash donations on your tax return. However, what if you're making a non-cash donation such as food, clothing, household items or even a vehicle? The Internal Revenue Service (IRS) does allow taxpayers to deduct the value of these types of donations but have become increasingly ... Online Donation Value Guide Spreadsheet - Printable and Editable PDF Form How to prepare Donation Value Guide Spreadsheet 1 Open the template You do not have to search for a sample of Donation Value Guide Spreadsheet online and download the document. Open up the sample immediately inside the editor with one click. 2 Fill the form Fill every single field in the template supplying legitimate details. goodwill donations worksheet Goodwill Charitable Donations Worksheet Universal Network — Db-excel.com db-excel.com. charitable goodwill itemization. Donation Value Guide 2020 Excel Spreadsheet - Fill Online, Printable ... 27 Non Cash Charitable Contributions Worksheet - Worksheet Information nuviab6ae4.blogspot.com.

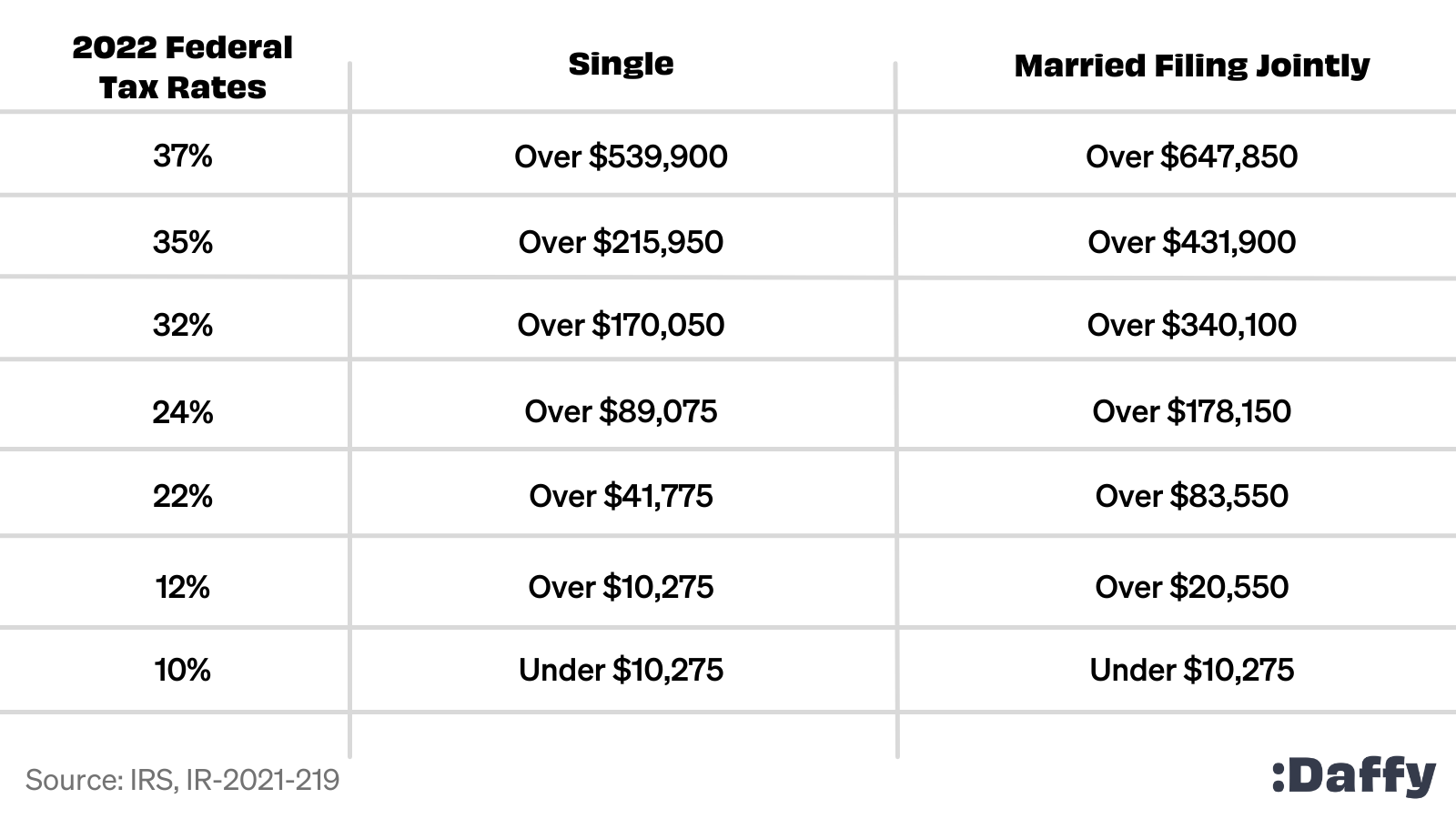

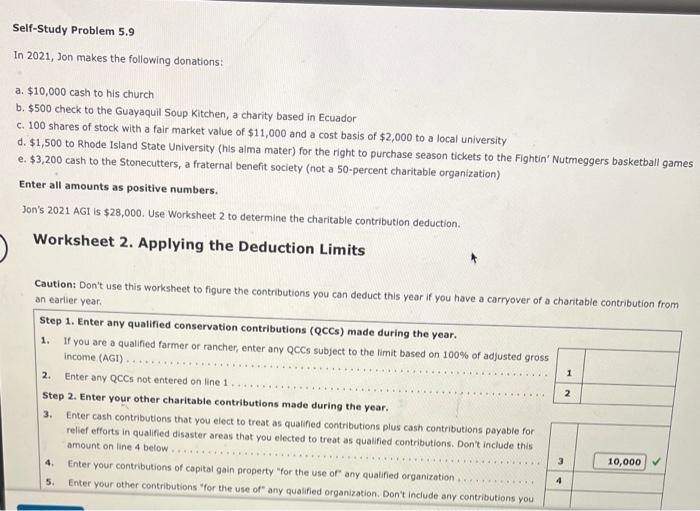

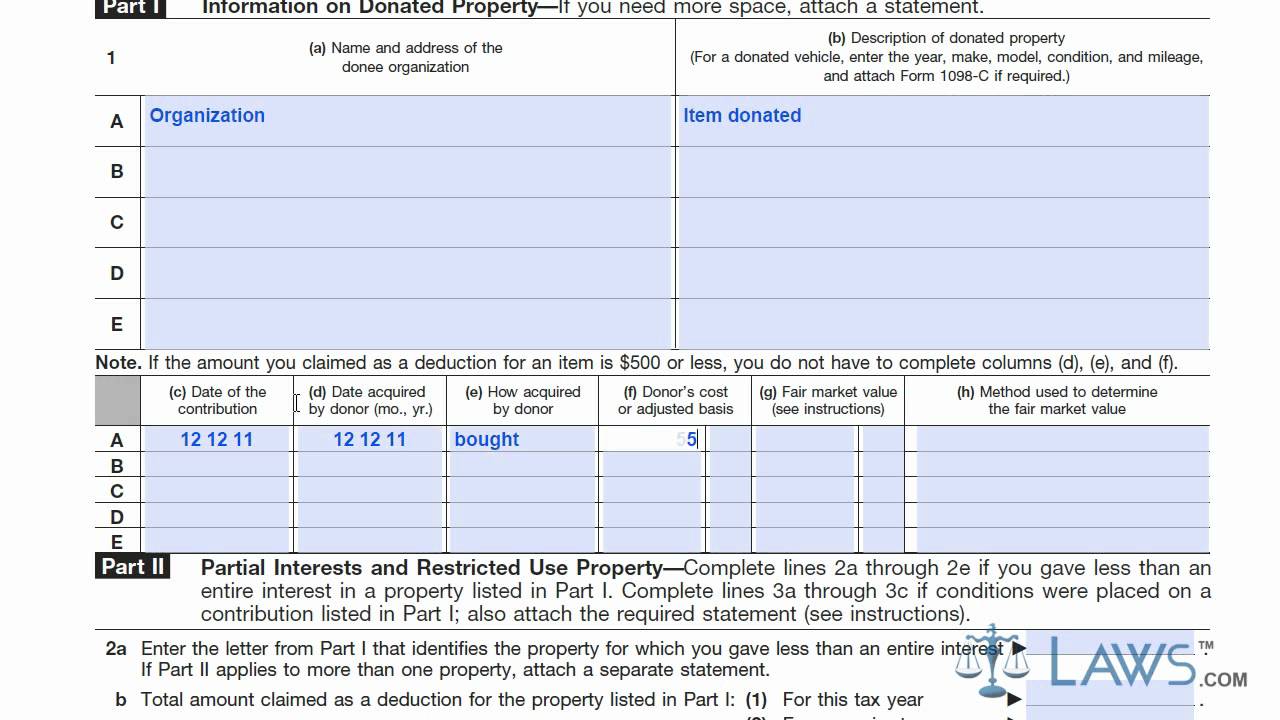

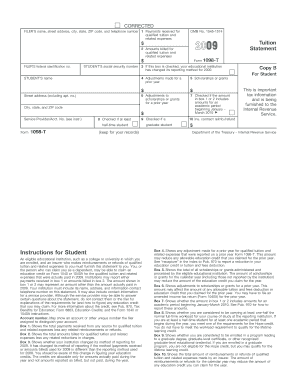

Non cash charitable contributions donations worksheet. 2022 Free Non Cash Charitable Contributions Worksheet Non Cash Charitable Contribution Worksheet PDF, Google Sheet, EXCEL from e-database.org. Worksheets are non cash charitable contributions donations work, non cash charitable contributions work, the. Most cell phones today can take pictures. This worksheet is provided as a convenience and aide in calculating. Source: About Form 8283, Noncash Charitable Contributions About Form 8283, Noncash Charitable Contributions Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500. Current Revision Form 8283 PDF Instructions for Form 8283 ( Print Version PDF) Recent Developments The Complete 2022 Charitable Tax Deductions Guide - Daffy Non-cash contributions: For non-cash contributions, the limit to make a deduction without a receipt is $500. Additionally, non-cash contributions also require an appraisal to determine the fair market value of the item you donated. If the value is $5,000 or less, you just need to hang onto the appraisal with your tax documents in case of an audit. › publications › p526Publication 526 (2021), Charitable Contributions | Internal ... If you make cash contributions or noncash contributions (other than capital gain property) during the year (1) to an organization described earlier under Second category of qualified organizations, or (2) “for the use of” any qualified organization, your deduction for those contributions is limited to 30% of your AGI, or if less, 50% of ...

Non Cash Charitable Contributions Donations Worksheet 2022 In this example, the charitable contribution portion of the payment is $60. Form 8283 is used to claim a deduction for a charitable contribution of property or similar items. Likewise, sweat shirts / pants my / our best guess of value non cash charitable contributions / donations worksheet. Take a picture of all items donated. XLS Noncash charitable deductions worksheet. - lstax.com Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the eupolcopps.euThe EU Mission for the Support of Palestinian Police and Rule ... EUPOL COPPS (the EU Coordinating Office for Palestinian Police Support), mainly through these two sections, assists the Palestinian Authority in building its institutions, for a future Palestinian state, focused on security and justice sector reforms. This is effected under Palestinian ownership and in accordance with the best European and international standards. Ultimately the Mission’s ... › 2022/10/12 › 23400986Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ...

› createJoin LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; Donation Value Guide 2021 Spreadsheet - Fill Online, Printable ... A Non Cash Charitable Contributions/Donations Worksheet is necessary for individuals who make non-cash charitable donations to the Salvation Army that do not exceed $5,000. People in the USA are encouraged to become contributors not only due to the moral virtues inherent to this act, but they will also be to claim corresponding deductions from ... Get NON-CASH DONATION WORKSHEET - US Legal Forms Ensure the details you fill in NON-CASH DONATION WORKSHEET is updated and accurate. Add the date to the record with the Date feature. Click on the Sign tool and create a digital signature. There are 3 available choices; typing, drawing, or uploading one. Be sure that every area has been filled in correctly. non cash charitable contributions/donations worksheet 2007-2022 - Fill ... Stick to these simple actions to get non cash charitable contributions/donations worksheet ready for sending: Get the document you require in the collection of legal forms. Open the template in the online editing tool. Read through the recommendations to discover which details you must give. Click the fillable fields and put the requested data.

PDF NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for ... NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for items in Good Condition) DONATED TO: DONATION DATE: MISCELLANEOUS LOW HIGH AVG QTY AMOUNT VALUE Adding Machines 24.00 90.00 57.00 Christmas Trees 18.00 60.00 39.00 Broiler Ovens 18.00 30.00 24.00 Copier 120.00 240.00 180.00

charitable contributions worksheet Financial Literacy: Donations and Charitable Giving 1st Grade by Tracy Pippin. 17 Pictures about Financial Literacy: Donations and Charitable Giving 1st Grade by Tracy Pippin : 29 Non Cash Charitable Contributions Donations Worksheet - Worksheet Resource Plans, Getting the Most from Individual Charitable Contributions and also The workbook-of-values.

Goodwill Donation Sheet Worksheets - Learny Kids You can & download or print using the browser document reader options. 1. VALUATION GUIDE FOR GOODWILL DONORS 2. Goodwill Donated Goods Value Guide 3. NON-CASH DONATION WORKSHEET (Based on Salvation Army ... 4. NON-CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET 5. The Salvation Army Valuation Guide for Donated Items ... 6.

› articles › personal-financeCharitable Contributions: Tax Breaks and Limits - Investopedia Jul 30, 2022 · Corporations also have an increased ceiling for cash charitable contributions in 2021. For cash donations, the ceiling increases from 10% to 25% of taxable income (with some adjustments) for “C ...

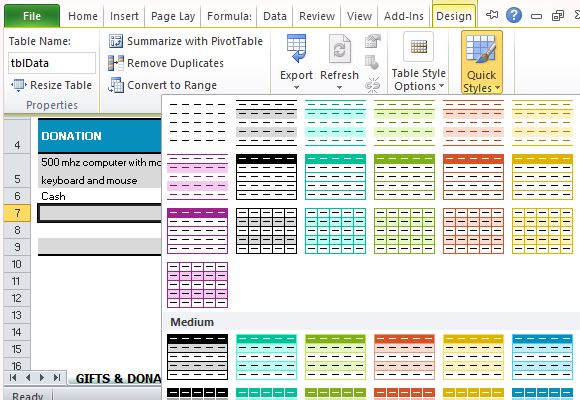

Charitable Contribution Worksheet | STAC Accounting Charitable Contribution Worksheet. Karen. December 20, 2017. Reporting Non Cash Charitable Donations can be extremely beneficial to your bottom line tax liability. Although, pulling it all together can also be painfully arduous. I am providing access to a worksheet built in excel. Download it and open in your 'sheets' app (excel, numbers ...

Goodwill Donation Worksheets - K12 Workbook If the total of your Non-Cash contributions is over $500 you will have to complete Form 8283 and we will need very specific details on each donation. You are responsible for determining the value of donated property. If value $5,000 or more get an appraisal. paid by cash, check or money order that you can verify with receipts.

Charitable Worksheet ≡ Fill Out Printable PDF Forms Online NOTE: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the values are believed to be reasonable, there are no guarantees or warranties as to their accuracy.

XLS Noncash charitable deductions worksheet. NON CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET. Insert Tax Year ===> Insert Date Given ===> ENTER ITEMS NOT PROVIDED FOR IN THE ABOVE CATEGORIES. SET YOUR OWN VALUE. WHAT IS YOUR ORIGINAL COST BASED ON RECIEPTS, OR YOUR BEST ESTIMATE, OF THE ITEMS DONATED? Charity's Address Blouse Coats Dresses Evening dresses Handbags WOMEN's CLOTHING

› donation-value-guide-4172778Donation Value Guide for 2021 Taxes - The Balance Dec 28, 2021 · Internal Revenue Service. “Expanded Tax Benefits Help Individuals and Businesses Give to Charity During 2021; Deductions Up to $600 Available for Cash Donations by Non-Itemizers.” Internal Revenue Service. “Topic No. 506 Charitable Contributions.” Internal Revenue Service. “Frequently Asked Questions on Gift Taxes.”

itsdeductibleonline.intuit.comTax Deductions - ItsDeductible Existing Customers. Sign In. New Customers. Create New Account. Your account allows you to access your information year-round to add or edit your deductions.

PDF Non-cash Charitable Contributions / Donations Worksheet NON-CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET TAXPAYERS NAME(S): Insert Tax Year ===> ... Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed ...

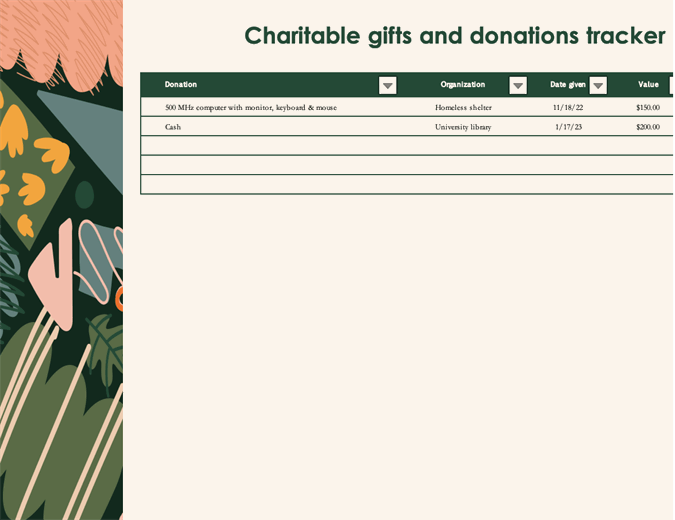

Charitable gifts and donations tracker - templates.office.com Charitable gifts and donations tracker. Keep track of your donations and charitable gifts throughout the year with this accessible donations tracker template. Use this Excel donation list template to mark whether each donation is tax-deductible for easy calculation of your deductions at the end of the year.

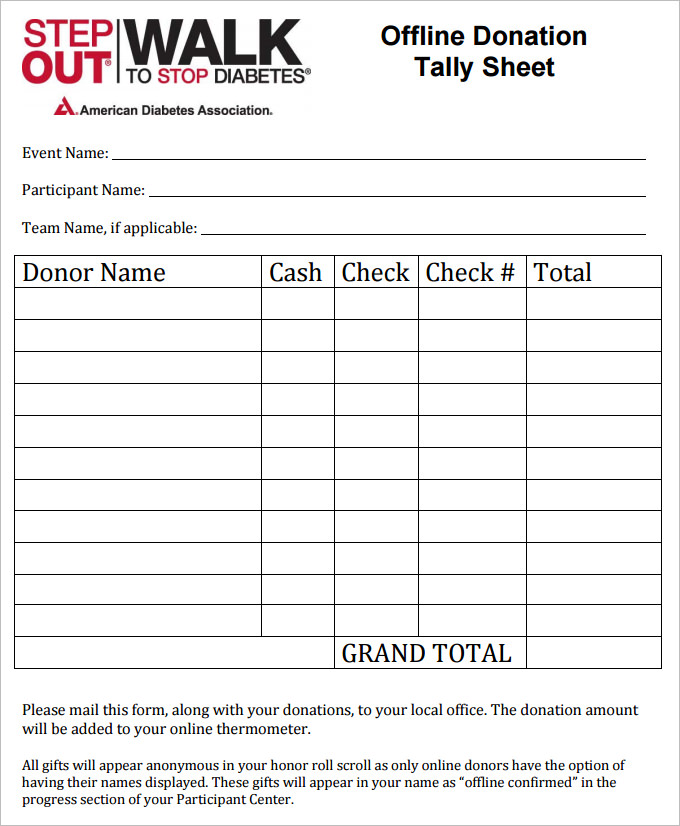

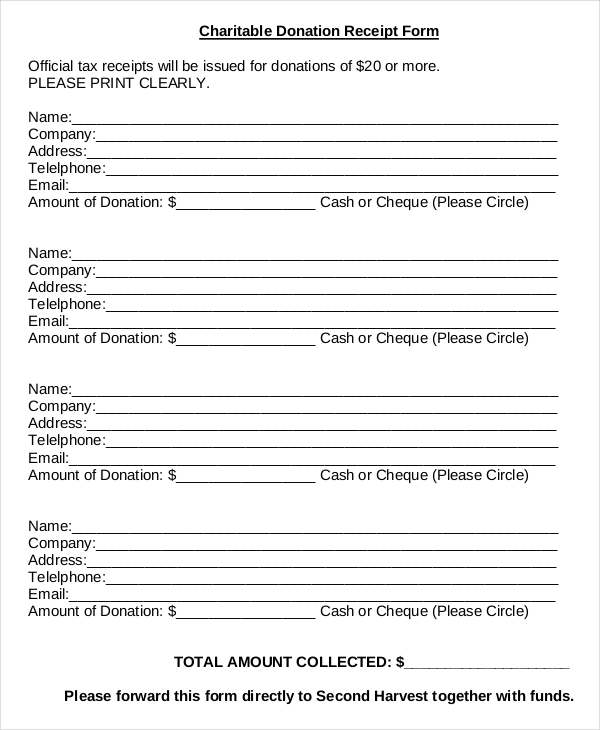

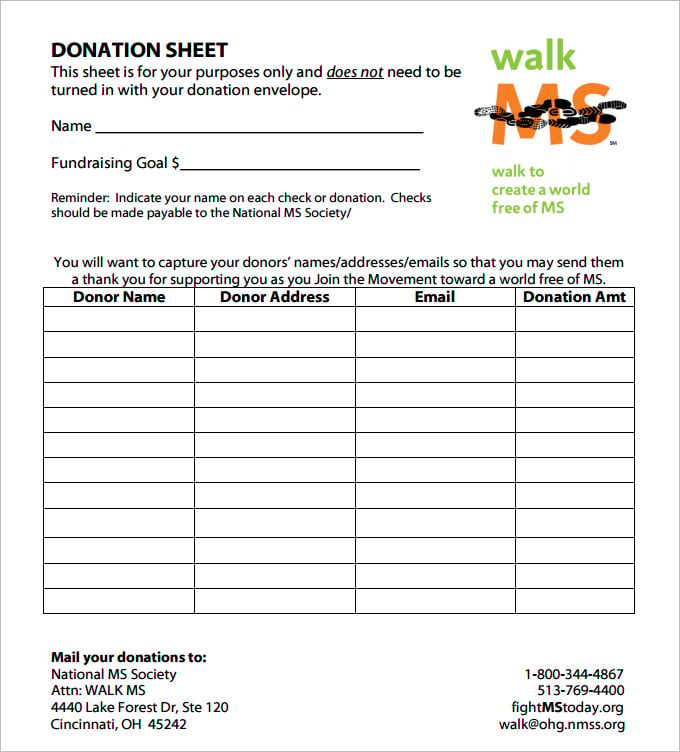

Donation Sheet Template - 9+Free PDF Documents Download | Free ... All of these documents and templates contain the details about the donor, the property that is getting donated, and other valid details that can be referred for later purposes. Charitable Donation Receipt Form secondharvest.ca Details File Format PDF Size: 23 KB Download Non-Cash Charitable Contribution Worksheet walterstax.com Details File Format

XLS Noncash charitable deductions worksheet. Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the Retain this worksheet with your receipts in your tax file.

Charitable Donations | H&R Block Non-cash donations of $5,000 or more If your non-cash single charitable donation for one item or a group of similar items is more than $5,000: The organization must give you a written acknowledgement. You must keep the records required under the rules for donations of more than $500 but less than $5,000.

Non-cash Charitable Contributions / Donations One should prepare a list for EACH separate entity and date DONATIONS are made. For example: If one made a donation onJuly 1st to ARC, and another donation to ARC on Sept. Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations.

Non Cash Charitable Contributions Donations Worksheet: Fillable ... Read the following instructions to use CocoDoc to start editing and completing your Non Cash Charitable Contributions Donations Worksheet: In the beginning, look for the "Get Form" button and click on it. Wait until Non Cash Charitable Contributions Donations Worksheet is ready. Customize your document by using the toolbar on the top.

goodwill donations worksheet Goodwill Charitable Donations Worksheet Universal Network — Db-excel.com db-excel.com. charitable goodwill itemization. Donation Value Guide 2020 Excel Spreadsheet - Fill Online, Printable ... 27 Non Cash Charitable Contributions Worksheet - Worksheet Information nuviab6ae4.blogspot.com.

Online Donation Value Guide Spreadsheet - Printable and Editable PDF Form How to prepare Donation Value Guide Spreadsheet 1 Open the template You do not have to search for a sample of Donation Value Guide Spreadsheet online and download the document. Open up the sample immediately inside the editor with one click. 2 Fill the form Fill every single field in the template supplying legitimate details.

Tax Tip: Deducting Non-Cash Charitable Donations for 2021 In our last article, Deducting Charitable Cash Contributions for 2021, we discussed the proper ways to deduct cash donations on your tax return. However, what if you're making a non-cash donation such as food, clothing, household items or even a vehicle? The Internal Revenue Service (IRS) does allow taxpayers to deduct the value of these types of donations but have become increasingly ...

:max_bytes(150000):strip_icc()/assetandcashdonationsforbusinesses-ee0eb9be3ea145b8bd327ece7729f86e.jpg)

0 Response to "44 non cash charitable contributions donations worksheet"

Post a Comment