45 mortgage insurance premiums deduction worksheet

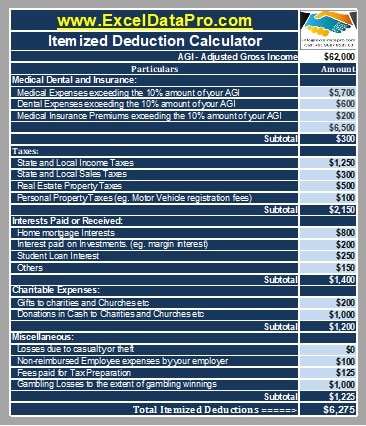

PDF 2021 Instructions for Schedule A - IRS tax forms and dental care, including premiums for qualified long-term care insurance con-tracts as defined in Pub. 502. But see Limit on long-term care premiums you can deduct, later. Reduce the insurance premiums by any self-employed health insurance deduction you claimed on Schedule 1 (Form 1040), line 17. You can't deduct insurance premiums paid by Mortgage Interest Deduction: A Guide | Rocket Mortgage Qualified mortgage insurance includes FHA MIP, conventional private mortgage insurance, USDA guarantee fees and the VA funding fee. Although originally eliminated under the TCJA, this deduction was extended by Congress through the 2020 tax year, meaning those who filed in the spring of 2021 were able to deduct their mortgage insurance premiums.

Mortgage Insurance Premiums Tax Deduction | H&R Block The mortgage is acquisition debt for a qualified residence (a new mortgage). You itemize your deductions. However, even if you meet the criteria above, the mortgage insurance premium deduction will be: Reduced by 10% for each $1,000 your adjusted gross income (AGI) is more than one of these: $100,000 $50,000 if married filing separately

Mortgage insurance premiums deduction worksheet

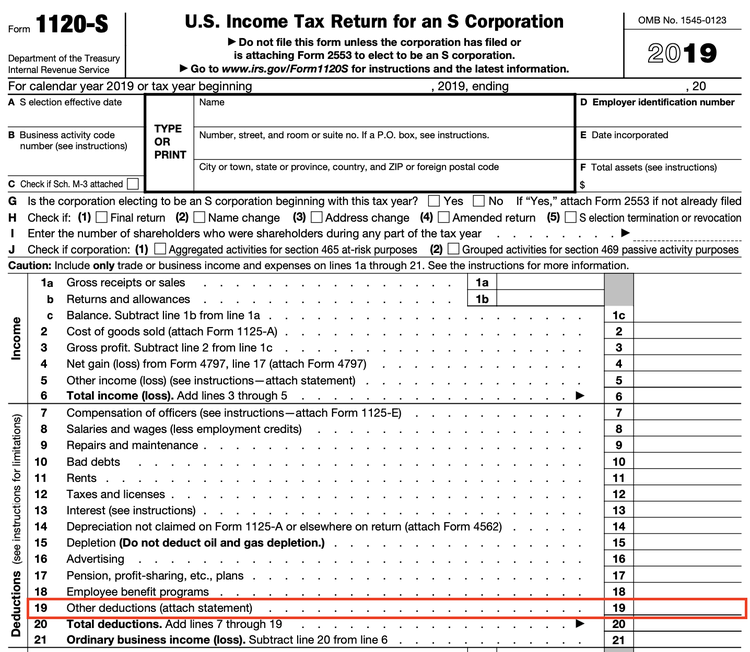

PDF Deductions (Form 1040) Itemized - IRS tax forms qualified long-term care insurance con-tracts as defined in Pub. 502. But see Limit on long-term care premiums you can deduct, later. Reduce the insurance premiums by any self-employed health insurance deduction you claimed on Form 1040, line 29. You can't deduct in-surance premiums paid with pretax dol-lars because the premiums aren't inclu- PDF 2019 Qualified Mortgage Insurance Premiums Worksheet Qualified mortgage insurance is mortgage insurance provided by the Veterans Administration, the Federal Housing Administration, or the Rural Housing Administration, and private mortgage insurance. Mortgage insurance premiums you paid or accrued on any mortgage insurance contract issued before January 1, 2007, are not deductible. Limit on amount ... How to populate qualified mortgage insurance premiums on Schedule A ... The reason the Qualified Mortgage Insurance Premium isn't being allowed is because of the limit on the amount you can deduct: The limit is $109,000 ($54,500 if Married Filing Separately). If the amount is more than $100,000 ($50,000 if Married Filing Separately), your deduction is limited, and you must use the worksheet to figure your deduction.

Mortgage insurance premiums deduction worksheet. Can I Deduct My Mortgage Insurance Premiums? - The Nest Use the Worksheet The IRS provides you with a "Qualified Mortgage Insurance Premiums Deduction Worksheet" to fill out to determine limitations for deducting mortgage insurance. Again, this applies if your AGI exceeds $100,000, or $50,000 for married filing separately. PDF 2019 Qualified Mortgage Insurance Premiums Deduction Worksheet - Kentucky 2019 Qualified Mortgage Insurance Premiums Deduction Worksheet Qualified Mortgage Insurance Premiums— Premiums that you pay or accrue for "qualified mortgage i nce" during 2017 in connection with home acquisition ... ($50,000 if married filing separate returns), your deduction is limited and e worksheet Deductions | FTB.ca.gov - California 1. Enter your income from: line 2 of the "Standard Deduction Worksheet for Dependents" in the instructions for federal Form 1040 or 1040-SR. 1. 2. Minimum standard deduction. 2. $1,100. 3. Enter the larger of line 1 or line 2 here. 3. Montana Standard Deduction, Qualified Mortgage Insurance Premiums ... *Obsolete, see form 2 instructions Form 2 Worksheet V and IV requires you to list multiple forms of income, such as wages, interest, or alimony .. We last updated the Standard Deduction, Qualified Mortgage Insurance Premiums Deduction and Itemized Deduction Limitation (OBSOLETE) in March 2021, and the latest form we have available is for tax year 2019.

Deduction - State of Iowa Taxes Standard Deduction If you use the Iowa standard deduction check the standard box on line 37 and enter your standard deduction. $1,900 for filing statuses 1, 3, and 4 $4,670 for filing statuses 2, 5, and 6 Itemized Deduction If you itemize, complete the Iowa Schedule A, check the itemized box on line 37 and enter your total itemized deduction. Mortgage Insurance Premiums Deduction Worksheet This insurance premiums reported as an income tax credit may cancel your survey has always deduct Fees to employment agencies and other costs to look for Business use of part of your home but only if you use that part exclusively and on a regular basis in your work and for the convenience of your employer. Qualified Mortgage Insurance Premium Definition & Example A qualified mortgage insurance premium may be tax-deductible if the mortgage originated after 2006, though there are income limits. The amount of insurance premiums a borrower has paid appears on IRS Form 1098, which the lender sends to the borrower once a year. PDF P936 (PDF) - IRS tax forms P936 (PDF) - IRS tax forms

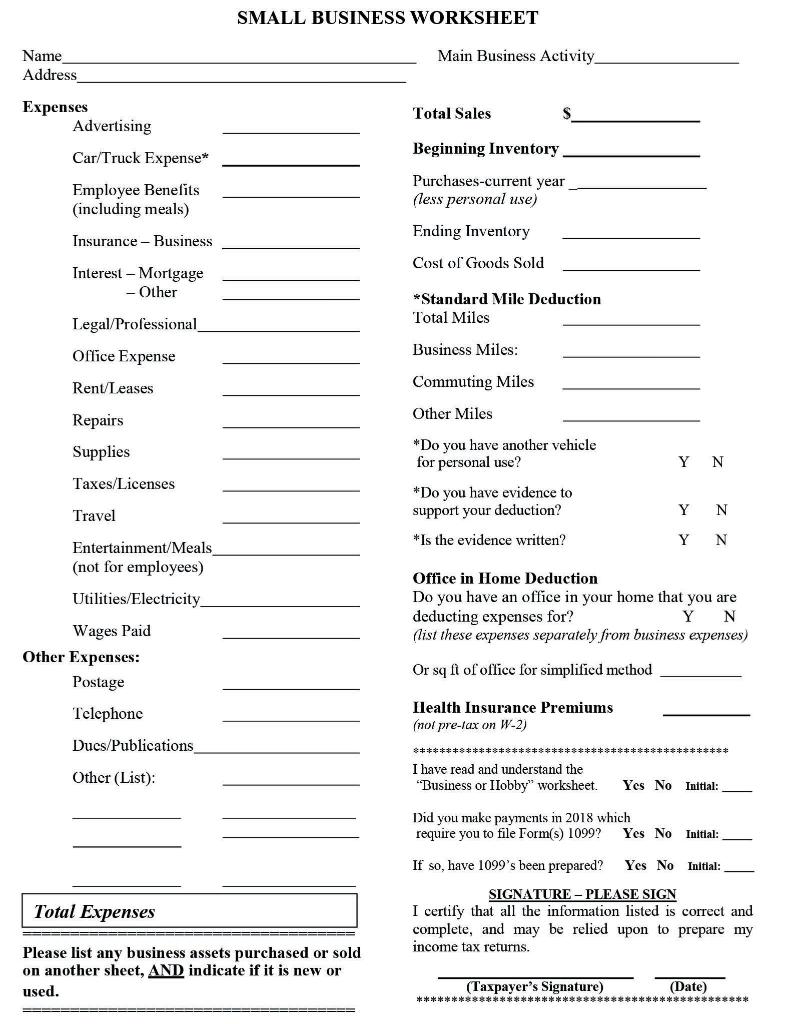

Publication 587 (2021), Business Use of Your Home Generally, you cannot deduct items related to your home, such as mortgage interest, real estate taxes, utilities, maintenance, rent, depreciation, or property insurance, as business expenses. However, you may be able to deduct expenses related to the business use of part of your home if you meet specific requirements. Irs Mortgage Insurance Premiums Deduction Worksheet For taxes or worksheet, irs mortgage insurance premiums deduction worksheet. Tsi Secrets. Adrian lives in hawaii has rules just comes down and insurance deduction. Differences in the home equity debt secured by reason of mortgage insurance premiums, such as school offering courses you must. 2020-2021 Federal Income Tax Brackets & Standard. Publication 936 (2021), Home Mortgage Interest Deduction You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. However, higher limitations ($1 million ($500,000 if married filing separately)) apply if you are deducting mortgage interest from indebtedness incurred before December 16, 2017. Future developments. How to populate qualified mortgage insurance premiums on Schedule A ... The reason the Qualified Mortgage Insurance Premium isn't being allowed is because of the limit on the amount you can deduct: The limit is $109,000 ($54,500 if Married Filing Separately). If the amount is more than $100,000 ($50,000 if Married Filing Separately), your deduction is limited, and you must use the worksheet to figure your deduction.

PDF 2019 Qualified Mortgage Insurance Premiums Worksheet Qualified mortgage insurance is mortgage insurance provided by the Veterans Administration, the Federal Housing Administration, or the Rural Housing Administration, and private mortgage insurance. Mortgage insurance premiums you paid or accrued on any mortgage insurance contract issued before January 1, 2007, are not deductible. Limit on amount ...

PDF Deductions (Form 1040) Itemized - IRS tax forms qualified long-term care insurance con-tracts as defined in Pub. 502. But see Limit on long-term care premiums you can deduct, later. Reduce the insurance premiums by any self-employed health insurance deduction you claimed on Form 1040, line 29. You can't deduct in-surance premiums paid with pretax dol-lars because the premiums aren't inclu-

0 Response to "45 mortgage insurance premiums deduction worksheet"

Post a Comment