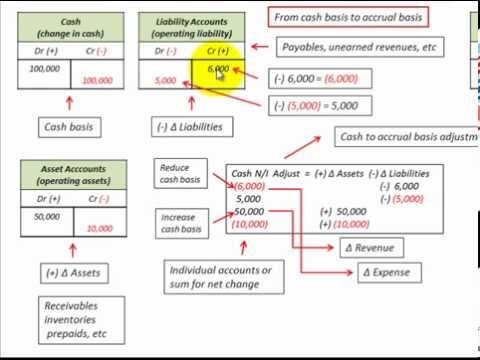

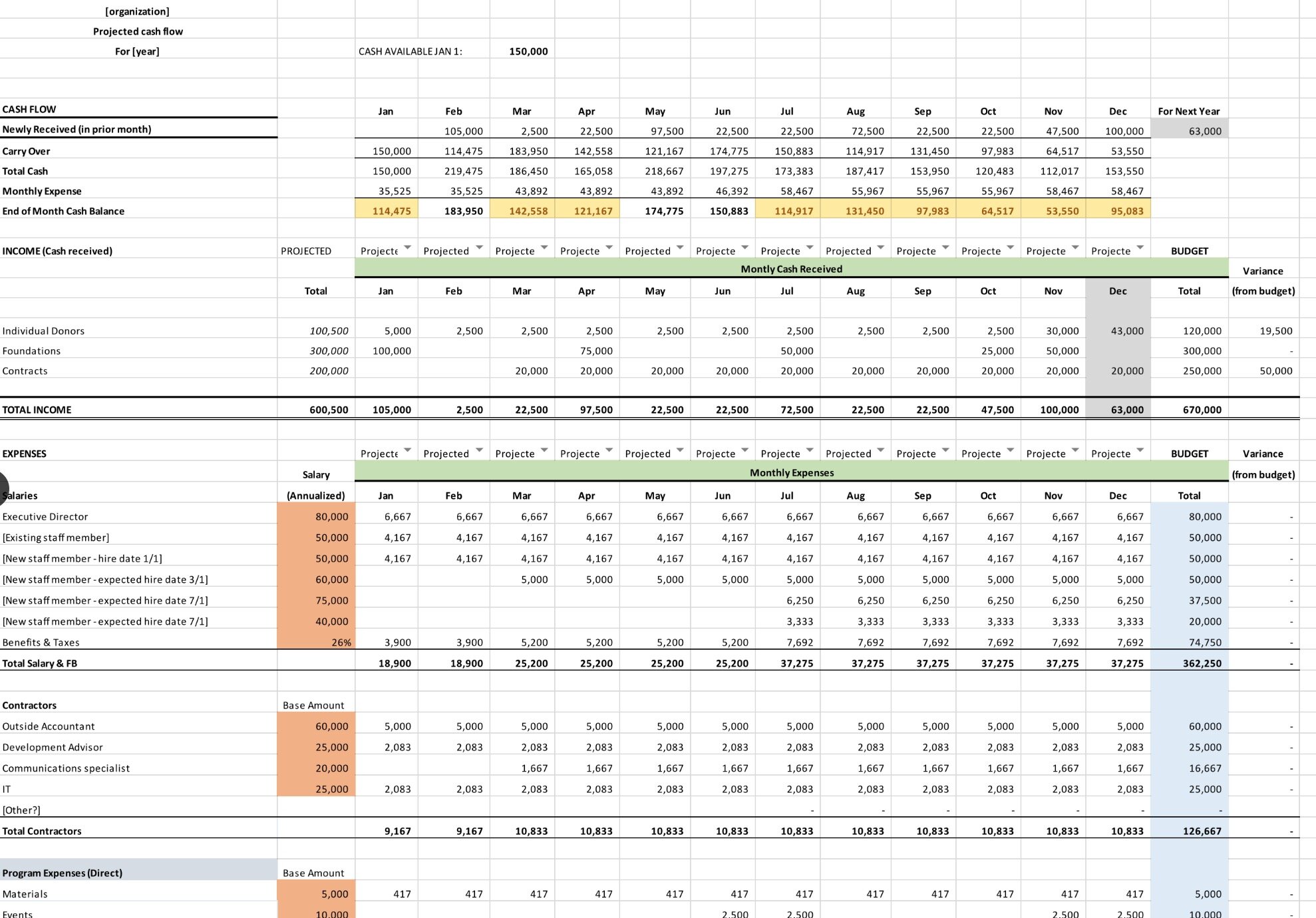

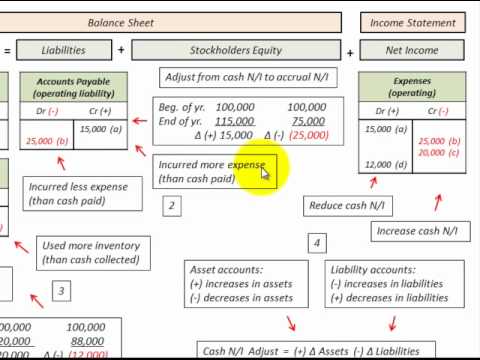

38 convert accrual to cash basis worksheet

Publication 527 (2020), Residential Rental Property WebIf you are a cash basis taxpayer, don’t deduct uncollected rent. Because you haven’t included it in your income, it’s not deductible. If you use an accrual method, report income when you earn it. If you are unable to collect the rent, you may be able to deduct it as a business bad debt. See chapter 10 of Pub. 535 for more information ... Intermediate Accounting IFRS 4th Edition by Donald E. Kieso ... Recall from your first accounting course the objective of accrual-basis accounting: it ensures that a company records events that change its financial statements in the periods in which the events occur, rather than only in the periods in which it receives or pays cash. Using the accrual basis to determine net income means that a company ...

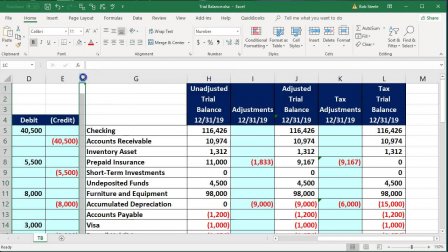

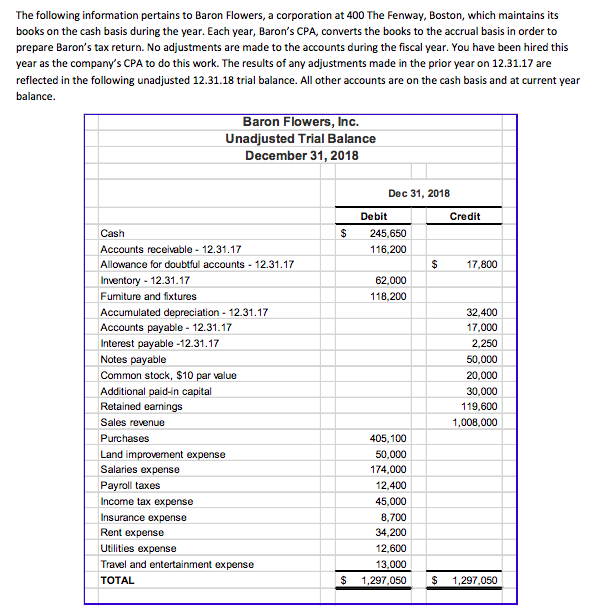

accrual to cash basis conversion formula WebSo, let's take a simple example. A client with $1 million in AR and $400K in accounts payable (AP) that switches from the overall accrual method to the overall cash method would have a favorable adjustment of $600K. The accrual basis requires the $1 million to be picked up in income, and the $400K allowed as deductions on the return. . Web. …

Convert accrual to cash basis worksheet

Publication 535 (2021), Business Expenses | Internal Revenue … WebYou are either a cash or accrual calendar year taxpayer. Last January, you leased property for 3 years for $6,000 per year. You pay the full $18,000 (3 x $6,000) during the first year of the lease. Because this amount is a prepaid expense that must be capitalized, you can deduct only $6,000 per year, the amount allocable to your use of the property in each year. Microsoft takes the gloves off as it battles Sony for its Activision ... Web12. Okt. 2022 · Microsoft is not pulling its punches with UK regulators. The software giant claims the UK CMA regulator has been listening too much to Sony’s arguments over its Activision Blizzard acquisition. Overwatch 2 reaches 25 million players, tripling Overwatch 1 daily ... Web14. Okt. 2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc

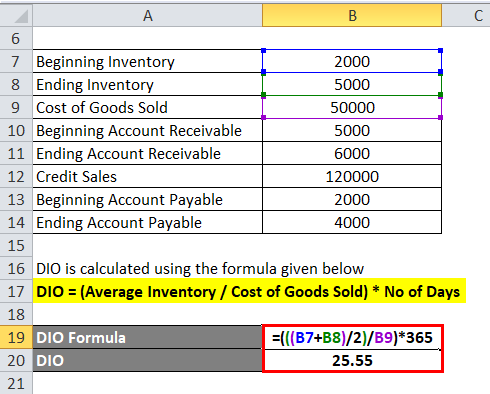

Convert accrual to cash basis worksheet. Publication 514 (2021), Foreign Tax Credit for Individuals WebIf you claim the credit for foreign taxes on an accrual basis, in most cases, you must use the average exchange rate for the tax year to which the taxes relate. This rule applies to accrued taxes relating to tax years beginning after 1997 and only under the following conditions. The foreign taxes are paid on or after the first day of the tax year to which they … Publication 590-A (2021), Contributions to Individual Retirement ... WebContributions, except for rollover contributions, must be in cash. See Rollovers, later. You must have a nonforfeitable right to the amount at all times. Money in your account can’t be used to buy a life insurance policy. Assets in your account can’t be combined with other property, except in a common trust fund or common investment fund. You must start … Cash Basis Accounting vs. Accrual Accounting - Bench Web10. Juli 2021 · Using cash basis accounting, income is recorded when you receive it, whereas with the accrual method, income is recorded when you earn it. Following the above example, using accrual accounting , if you invoice a client for $5,000 in December of 2017, you would record that transaction as a part of your 2017 income (and thus pay taxes on … Chapter 3 Accrual Accounting and Income Flashcards | Quizlet Under accrual accounting, the doctor recognizes revenue: A) in March. B) in July. C) in either March or July. D) at a time that cannot be determined from the facts., A doctor performed surgery in April and did not receive cash payment from the patient until August. Under cash-basis accounting, the doctor recognizes revenue: A) in April. B) in ...

How to convert accrual basis to cash basis accounting — … Web21. Mai 2022 · How do we convert accrual basis accounting records to the cash basis? To convert from accrual basis to cash basis accounting, follow these steps: Subtract accrued expenses. If an expense has been accrued because there is no supplier invoice for it, remove it from the financial statements. The easiest source of this information is the … Publication 550 (2021), Investment Income and Expenses WebLine 7; also use Schedule D, Form 8824, and the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet *Report any amounts in excess of your basis in your mutual fund shares on Form 8949. Use Part II if you held the shares more than 1 year. Use Part I if you held your mutual fund shares 1 year or less. Overwatch 2 reaches 25 million players, tripling Overwatch 1 daily ... Web14. Okt. 2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc Microsoft takes the gloves off as it battles Sony for its Activision ... Web12. Okt. 2022 · Microsoft is not pulling its punches with UK regulators. The software giant claims the UK CMA regulator has been listening too much to Sony’s arguments over its Activision Blizzard acquisition.

Publication 535 (2021), Business Expenses | Internal Revenue … WebYou are either a cash or accrual calendar year taxpayer. Last January, you leased property for 3 years for $6,000 per year. You pay the full $18,000 (3 x $6,000) during the first year of the lease. Because this amount is a prepaid expense that must be capitalized, you can deduct only $6,000 per year, the amount allocable to your use of the property in each year.

.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

0 Response to "38 convert accrual to cash basis worksheet"

Post a Comment