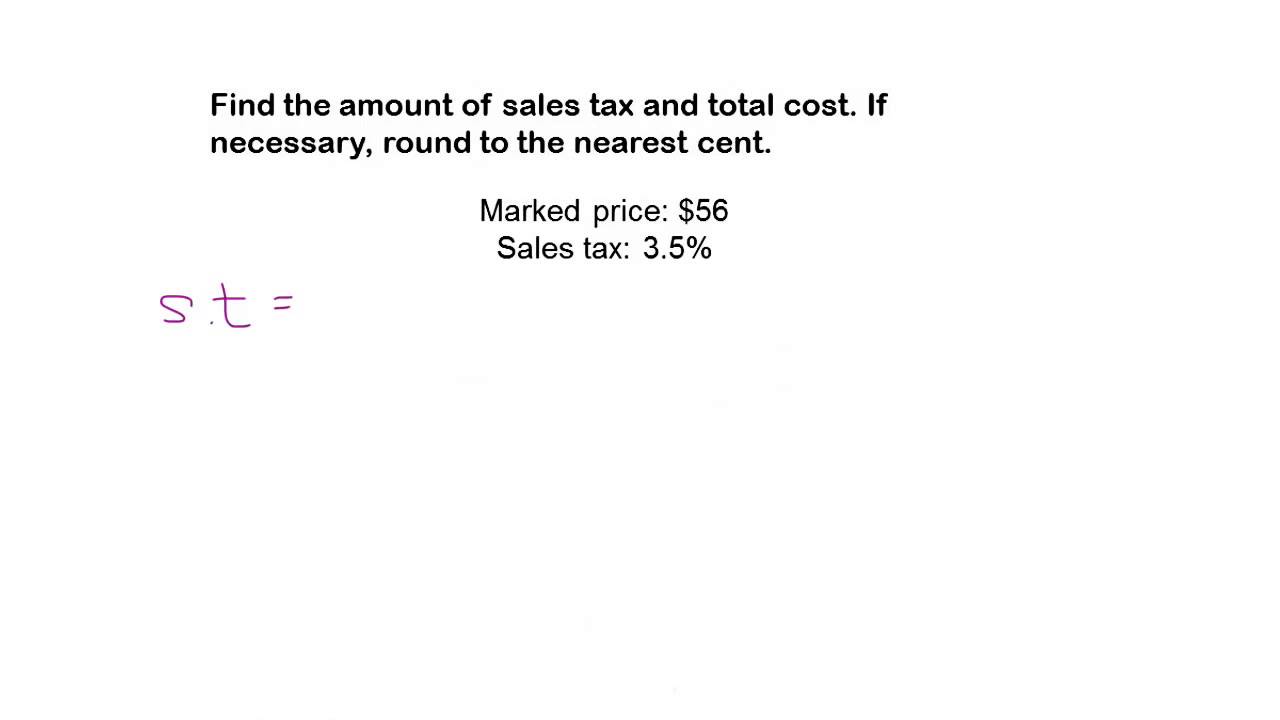

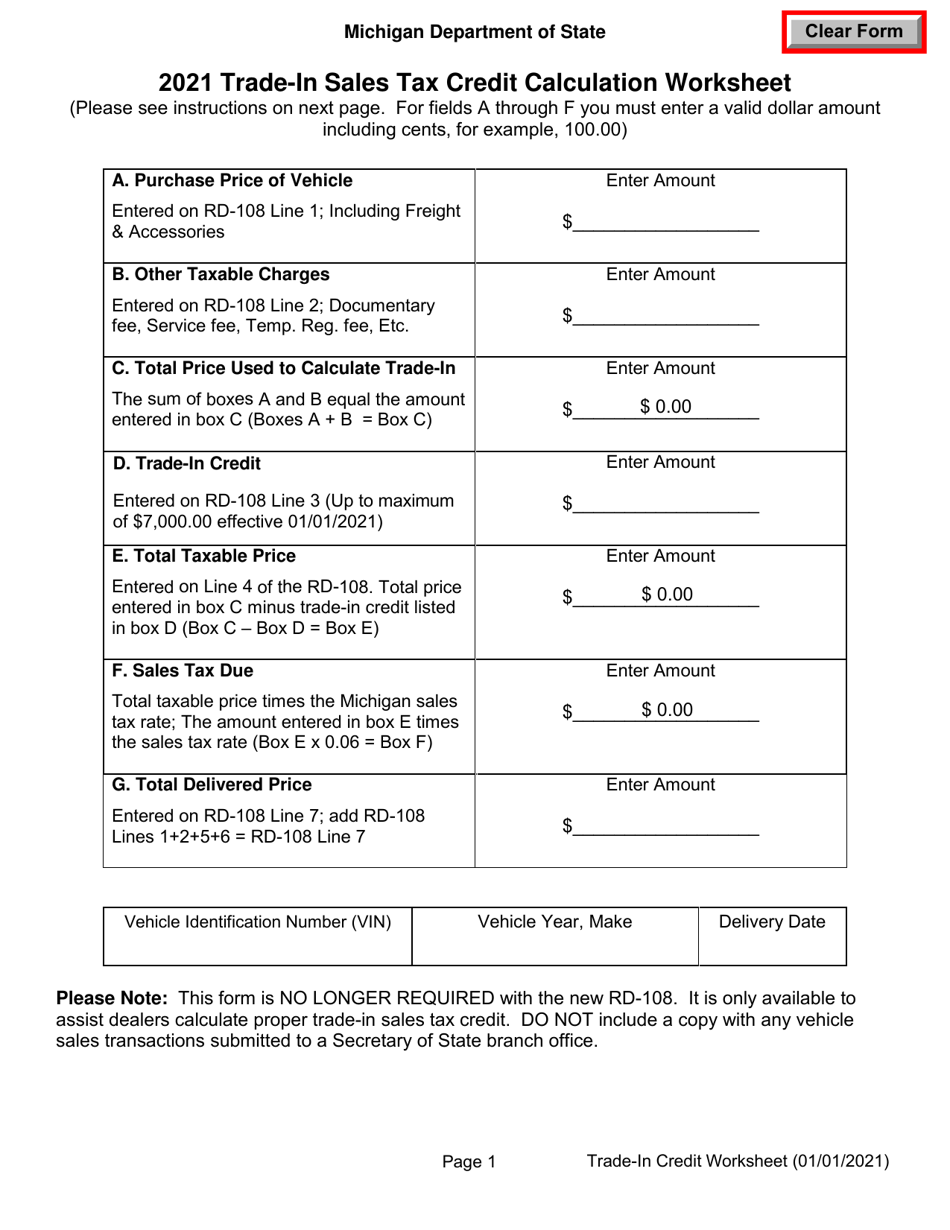

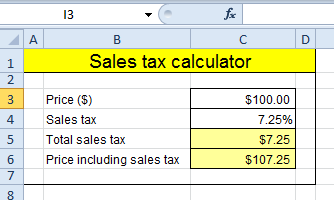

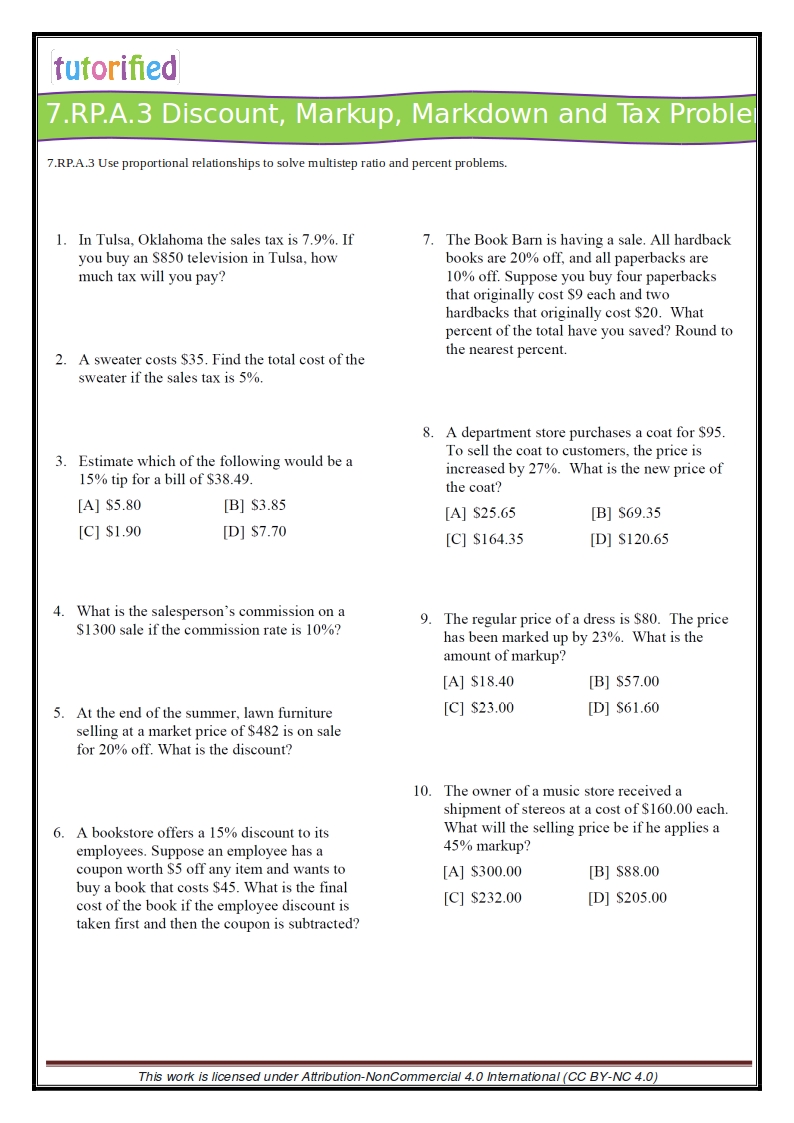

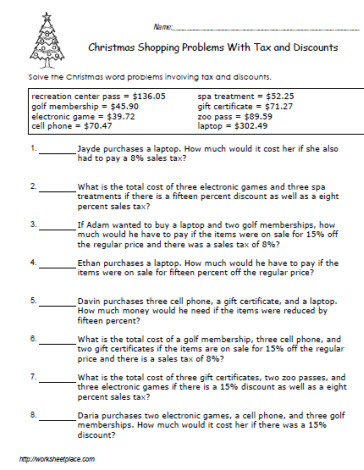

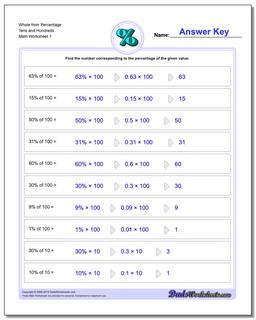

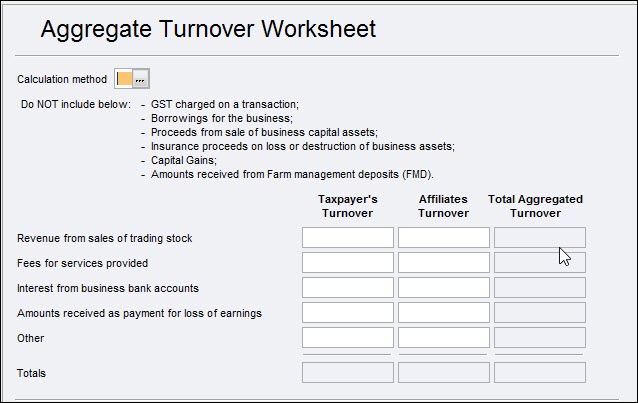

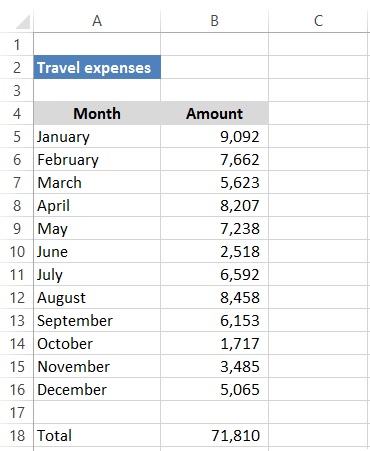

40 calculating sales tax worksheet

› taxtopics › tc703Topic No. 703 Basis of Assets | Internal Revenue Service Oct 07, 2022 · Cost includes sales tax and other expenses connected with the purchase. Your basis in some assets isn't determined by the cost to you. If you acquire property other than through a purchase (such as a gift or an inheritance), refer to Publication 551, Basis of Assets for more information. › publications › p523Publication 523 (2021), Selling Your Home - IRS tax forms Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

sftaxcounsel.com › demystifying-irs-form-1116Demystifying IRS Form 1116- Calculating Foreign Tax Credits Calculating foreign tax credits and completing a Form 1116 can be complicated. If you are uncertain how to properly compute a foreign tax credit or complete a Form 1116, you should contact a qualified international tax professional. Anthony Diosdi is one of several tax attorneys and international tax attorneys at Diosdi Ching & Liu, LLP.

Calculating sales tax worksheet

› publications › p17Publication 17 (2021), Your Federal Income Tax | Internal ... Additional tax on excess advance child tax credit payments. If you received advance child tax credit payments during 2021 and the credits you figure using Schedule 8812 (Form 1040) are less than what you received, you may owe an additional tax. › publications › p590aPublication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021). › publications › p527Publication 527 (2020), Residential Rental Property Tax-free exchange of rental property occasionally used for personal purposes. If you meet certain qualifying use standards, you may qualify for a tax-free exchange (a like-kind or section 1031 exchange) of one piece of rental property you own for a similar piece of rental property, even if you have used the rental property for personal purposes.

Calculating sales tax worksheet. study.com › academy › practiceQuiz & Worksheet - Calculating Payroll Costs | Study.com This worksheet and quiz will let you practice the following skills: Interpreting information - verify you can read information regarding how to calculate taxes and interpret it correctly › publications › p527Publication 527 (2020), Residential Rental Property Tax-free exchange of rental property occasionally used for personal purposes. If you meet certain qualifying use standards, you may qualify for a tax-free exchange (a like-kind or section 1031 exchange) of one piece of rental property you own for a similar piece of rental property, even if you have used the rental property for personal purposes. › publications › p590aPublication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021). › publications › p17Publication 17 (2021), Your Federal Income Tax | Internal ... Additional tax on excess advance child tax credit payments. If you received advance child tax credit payments during 2021 and the credits you figure using Schedule 8812 (Form 1040) are less than what you received, you may owe an additional tax.

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/Screenshot-2018-07-05-17.53.15.jpg?strip=all&lossy=1&w=2560&ssl=1)

0 Response to "40 calculating sales tax worksheet"

Post a Comment