42 clergy housing allowance worksheet

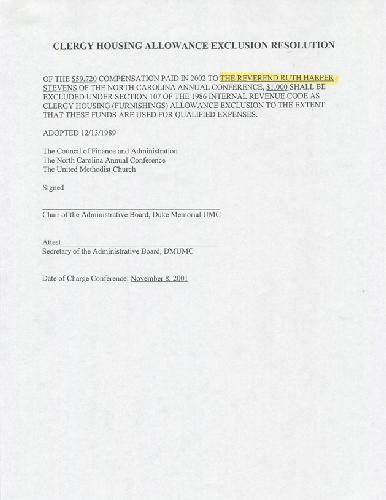

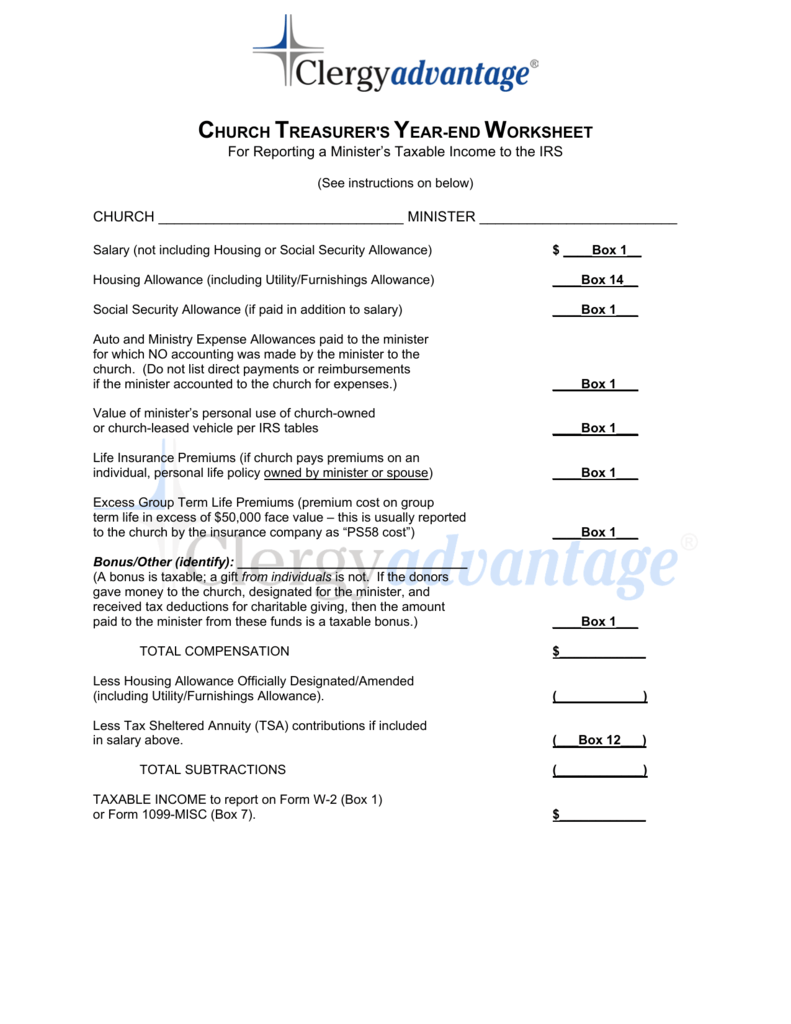

Federal Income Tax and Benefit Guide – 2021 – Completing … clergy’s housing allowance or an amount for eligible utilities from box 30 of your T4 slips. You may be able to claim a deduction on line 23100 of your return. If a housing allowance or an amount for eligible utilities is shown in box 14 of your T4 slips , subtract the amount in box 30 of your T4 slips from the amount in box 14 and include the difference on line 10100 of your return › ministers-housing-allowanceMinister's Housing Allowance — Servant Solutions As recently as the Clergy Housing Allowance Clarification Act of 2002, Congress reinforced and clarified the provisions by adding language to the code about the fair rental value. The proper designation of a cash housing allowance can result in significant tax savings for the qualifying minister.

American Family News 2. elok. 2022 · American Family News (formerly One News Now) offers news on current events from an evangelical Christian perspective. Our experienced journalists want to glorify God in what we do.

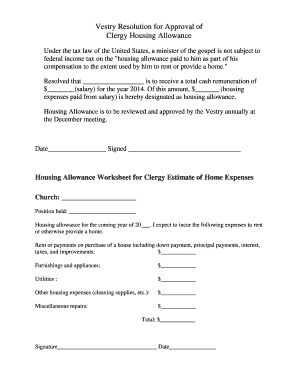

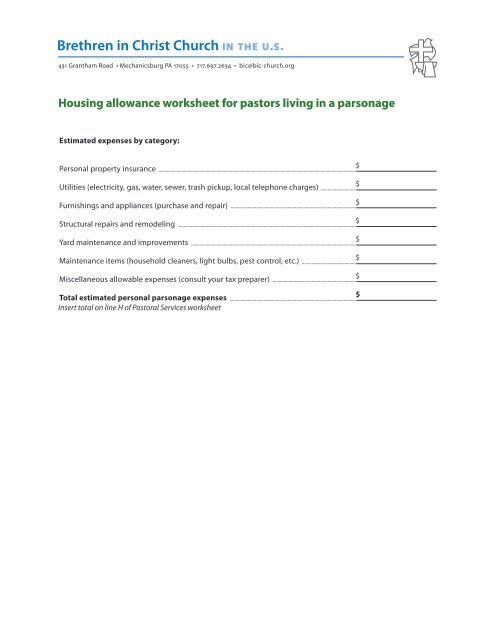

Clergy housing allowance worksheet

Fair Market Rent RentData.org - Comprehensive Fair Market Rent Estimates By City, State and ZIP Code. Find the Rental Value of Your Home or Appartment. Minister's Housing Allowance — Servant Solutions Housing Allowance Worksheet You may also find this excel spreadsheet useful in helping you track your full year expenses so you can determine your Housing Allowance amount. Frequently Asked Questions . How long has the clergy housing allowance been a part of the U.S. tax code? It was made a part of the Tax Code in 1921. It has been ... 2021 Instructions for Schedule SE - IRS tax forms foreign housing exclusion or deduction. See Pub. 517 for additional details re-garding social security for Members of the Clergy and Religious Workers. Members of Certain Religious Sects If you have conscientious objections to social security insurance because of your membership in and belief in the teachings of a religious sect recognized

Clergy housing allowance worksheet. Publication 936 (2021), Home Mortgage Interest Deduction Ministers' housing allowance, Ministers' and military housing allowance. Missing children, photographs of, Reminders Mixed-use mortgages, Mixed-use mortgages. Mortgage Insurance Premiums, Mortgage Insurance Premiums Mortgage interest, Publication 936 - Introductory Material, Part I. Home Mortgage Interest Cooperative housing, Figuring ... Ministers' Compensation & Housing Allowance - IRS tax forms 6. syysk. 2022 · For more information on a minister’s housing allowance, refer to Publication 517, Social Security and Other Information for Members of the Clergy and Religious Workers. For information on earnings for clergy and reporting of self-employment tax, refer to Tax Topic 417, Earnings for Clergy. › blog › everything-ministersEverything Ministers/ Clergy Should Know About Their Housing ... Also important to bear in mind is that while the amount subject to income tax includes gross wages minus housing allowance (and any other pre-tax benefits), the entire clergy salary is subject to self-employment tax. Download: Housing Allowance Worksheet Package for Clergy and Churches holstonconference.com › HousingAllowanceQA-2004HOUSING ALLOWANCE Q&As (FOR UNITED METHODIST CLERGY) What is ... report the $8,000 housing allowance as income for federal income tax purposes. The pastor cannot claim a housing allowance exclusion for the entire amount of his expenses or for the entire fair rental value of the home, because the exclusion cannot exceed the designated housing allowance, in this case, $8,000. 5.

Market Rent - RentData.org RentData.org - Comprehensive Fair Market Rent Estimates By City, State and ZIP Code. Find the Rental Value of Your Home or Appartment. › faqs › interest-dividends-other-typesMinisters' Compensation & Housing Allowance | Internal ... Sep 06, 2022 · For more information on a minister’s housing allowance, refer to Publication 517, Social Security and Other Information for Members of the Clergy and Religious Workers. For information on earnings for clergy and reporting of self-employment tax, refer to Tax Topic 417, Earnings for Clergy. pastorswallet.com › how-do-you-report-your-housingHow Do You Report Your Clergy Housing Allowance To The IRS? Sep 13, 2021 · The housing allowance is exempt from income and should therefore not be reported here. If it is, the IRS will think you owe more in taxes and you will have a mess on your hands. If your church accidentally includes your housing allowance in Box 1, have them correct the mistake right away by filing an amended Form W-2. Boxes 3, 4, 5, and 6 Lifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing

Gross Compensation - Pennsylvania Department of Revenue Gross Compensation Overview Definition of Gross Employee Compensation for Pennsylvania Personal Income Tax. For Pennsylvania personal income tax purposes, the term “compensation” includes salaries, wages, commissions, bonuses and incentive payments whether based on profits or otherwise, fees, tips and similar remuneration received for services rendered as an … › pub › irs-pdfTax Guide for Churches & Religious Organizations - IRS tax forms Tax Exempt and Government Entities EXEMPT ORGANIZATIONS Tax Guide for Churches & Religious Organizations 501(c)(3) Publication 1828 (Rev. 8-2015) Catalog Number 21096G Department of the Treasury Internal Revenue Service HOUSING ALLOWANCE Q&As (FOR UNITED METHODIST CLERGY… The Clergy Housing Allowance Clarification Act of 2002 ("Act") ... Housing Allowance Estimate Worksheet, Attachment C to this document, could be helpful. In addition, this worksheet can assist clergy in planning for out-of-the-ordinary housing expenditures in the upcoming year. 8. 2021 Instructions for Schedule SE - IRS tax forms foreign housing exclusion or deduction. See Pub. 517 for additional details re-garding social security for Members of the Clergy and Religious Workers. Members of Certain Religious Sects If you have conscientious objections to social security insurance because of your membership in and belief in the teachings of a religious sect recognized

Minister's Housing Allowance — Servant Solutions Housing Allowance Worksheet You may also find this excel spreadsheet useful in helping you track your full year expenses so you can determine your Housing Allowance amount. Frequently Asked Questions . How long has the clergy housing allowance been a part of the U.S. tax code? It was made a part of the Tax Code in 1921. It has been ...

Fair Market Rent RentData.org - Comprehensive Fair Market Rent Estimates By City, State and ZIP Code. Find the Rental Value of Your Home or Appartment.

.jpg)

0 Response to "42 clergy housing allowance worksheet"

Post a Comment