42 colorado pension and annuity exclusion worksheet

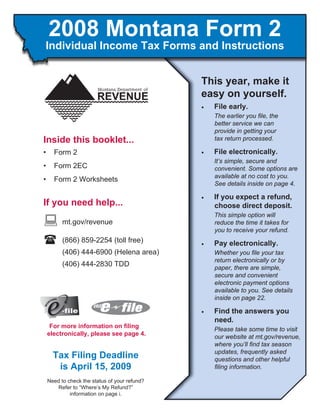

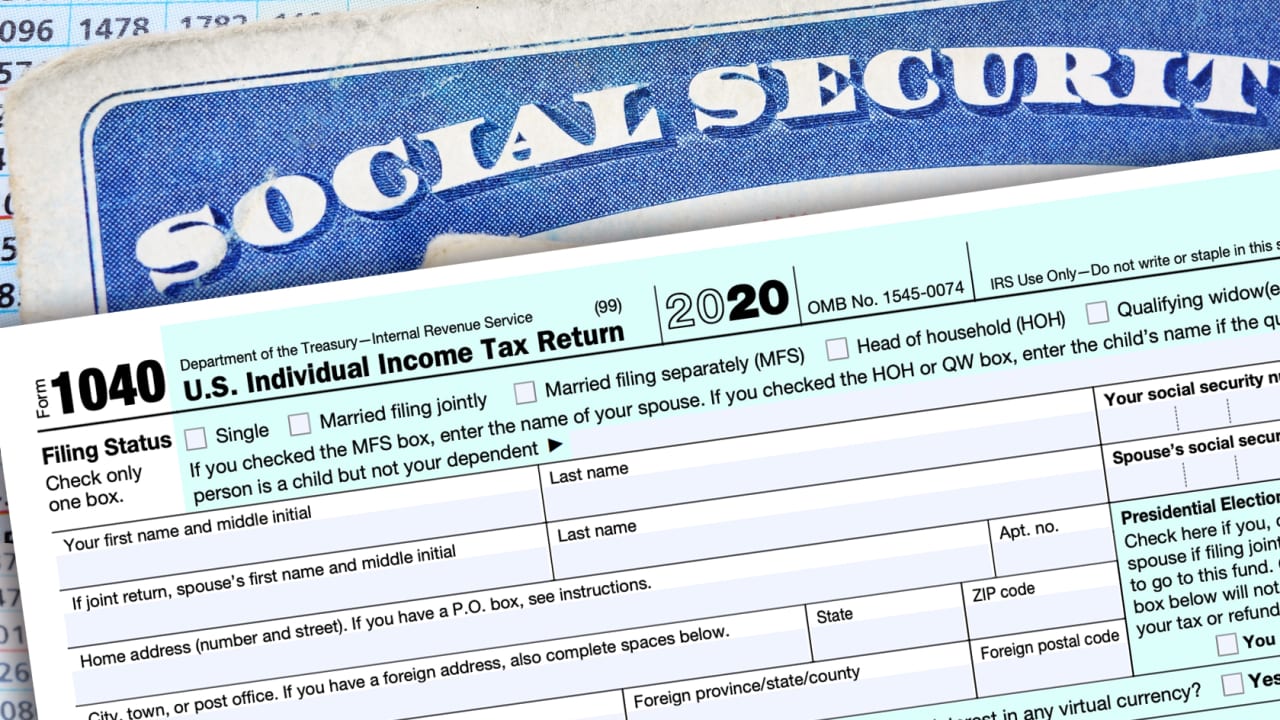

PDF Colorado enacts several law changes impacting income and ... - Deloitte pension annuity benefits for tax years beginning on or after January 1, 2022, for certain taxpayers who are 65 or older to include all federally taxed social security benefits. • HB 1311 limits deductions for contributions to 529 Plans for tax year s beginning on or after January 1, 2022 to $20,000 per beneficiary Microsoft takes the gloves off as it battles Sony for its Activision ... 12/10/2022 · Microsoft is not pulling its punches with UK regulators. The software giant claims the UK CMA regulator has been listening too much to Sony’s arguments over its Activision Blizzard acquisition.

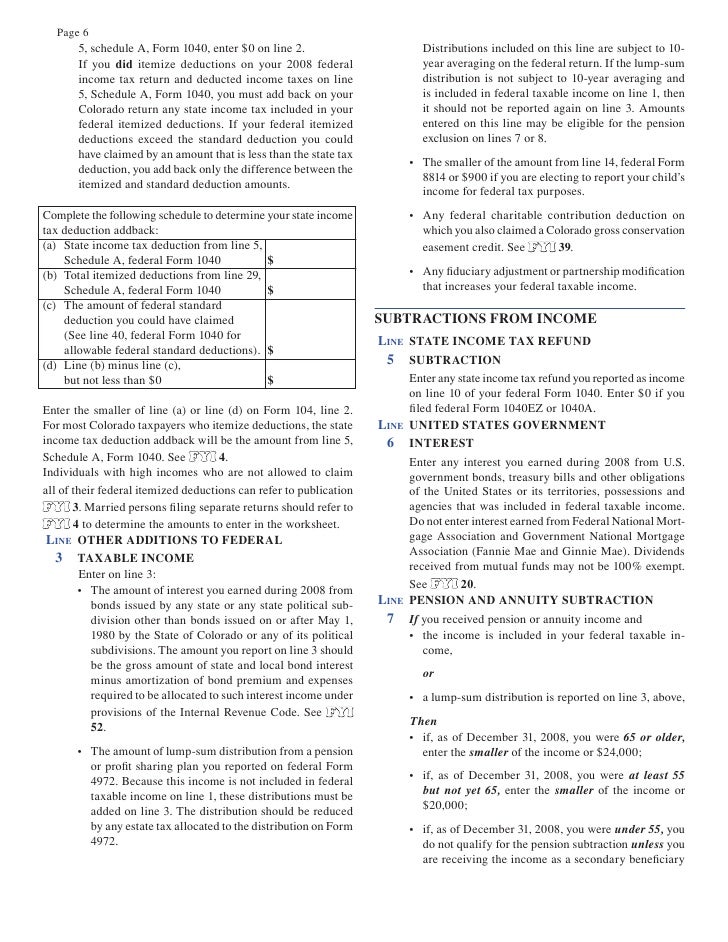

PDF PENSION OR ANNUITY DEDUCTION - Colorado PENSION OR ANNUITY D EDUCTION. PENSION OR ANNUITY DEDUCTION . EVALUATION RESULTS. WHAT IS THE TAX EXPENDITURE? The Pension or Annuity Deduction [Section 3922-104(4)(f), C.R.S.] - allows individuals who are at least 55 years of age at the end of the taxable year to deduct "amounts received as pensions or annuities from

Colorado pension and annuity exclusion worksheet

Colorado's Pension and Annuity Subtraction - Jim Saulnier, CFP If you are 65 or older you can subtract up to $24,000 of income If you are between 55 and 65 you can subtract up to $20,000 If you are under 55 years old (utilizing the beneficiary exception) you can subtract up to $20,000 Considering the Centennial State has a flat income tax of 4.63% these subtractions often translate to substantial tax savings. PDF Common questions and answers about pension subtraction adjustments CO-60 (11/18) (page 4 of 4) Rollovers Q: If a qualifying pension is rolled over into an annuity, will the distribution from the annuity qualify for the $20,000 pension and annuity income exclusion? A: Yes, if the income was included in FAGI and provided all other requirements are met (over 59½, periodic payments, attributable to personal services performed before retirement and an employer- 42.15.219 : PENSION AND ANNUITY INCOME EXCLUSION - Montana Rule: 42.15.219. (1) For tax years beginning January 1, 2016, the pension and annuity exclusion is limited to the lesser of the pension and annuity income received or $4,070 for a single person or married couple where only one person receives pension or annuity income. (a) The exclusion is reduced $2 for every $1 of federal adjusted gross ...

Colorado pension and annuity exclusion worksheet. Colorado Retirement Tax Friendliness - SmartAsset Colorado offers a retirement income deduction of $20,000 annually for persons age 55 to 64 and $24,000 annually for persons age 65 and up. For married couples, each person can claim the deduction. It applies to Social Security, so someone with Social Security income of $18,000, which is close to the average for U.S. households, would not need ... Dictionary of Accounting Terms.pdf - Academia.edu Dictionary of Accounting Terms.pdf Could Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal. Free Tax Filing | File Simple Federal Taxes Online for Free ... Easy, fast and free online tax filing software to file simple federal taxes from TaxAct. Step by step guidance and free support. Start filing today!

Rule 39-22-104 (4) (f) - PENSION AND ANNUITY SUBTRACTION ... - Casetext (c) Pension and annuity benefits, including any lump-sum distributions from sources in paragraph (1) (a) (i) - (iii), paid to an individual who is less than 55 years of age at the close of the tax year if such benefits were received because of the death of the person who was originally entitled to receive such benefits. Income 25: Pension and Annuity Subtraction | Colorado tax If you meet certain qualifications, you can subtract some or all of your pension and annuity income on your Colorado individual income tax return (Form 104) ... File Simple Federal Taxes Online for Free - TaxAct Easy, fast and free online tax filing software to file simple federal taxes from TaxAct. Step by step guidance and free support. Start filing today! Connecticut Department of Revenue Services NEW Highway Use Fee - Registration is now open for certain carriers to register for the new Connecticut Highway Use Fee - Click here for more information. IMPORTANT INFORMATION - the following tax types are now available in myconneCT: Individual Income Tax, Attorney Occupational Tax, Unified Gift and Estate Tax, Controlling Interest Transfer Tax, and Alcoholic Beverage Tax.

Achiever Papers - We help students improve their academic standing All our academic papers are written from scratch. All our clients are privileged to have all their academic papers written from scratch. These papers are also written according to your lecturer’s instructions and thus minimizing any chances of plagiarism. Connecticut Department of Revenue Services NEW Highway Use Fee - Registration is now open for certain carriers to register for the new Connecticut Highway Use Fee - Click here for more information. IMPORTANT INFORMATION - the following tax types are now available in myconneCT: Individual Income Tax, Attorney Occupational Tax, Unified Gift and Estate Tax, Controlling Interest Transfer Tax, and Alcoholic … Pension Subtraction - Colorado Springs CPA - BiggsKofford Colorado is one of the states that allows a pension/annuity subtraction for taxpayers who are at least 55 years of age and beneficiaries of any age who are ... Income 25: Pension and Annuity Subtraction - FreeTaxUSA Colorado pension and annuity subtraction. Page 2 of 4 (03/21) HOW TO CALCULATE THE PENSION AND ANNUITY SUBTRACTION The amount of the pension and annuity subtraction is equal to the amount of your qualifying income, except that the subtraction cannot exceed the maximum allowable amount based upon your age. The following table reflects the

New York - Government Pension Exclusion - TaxAct This would also be reported on Line 10 of Form IT-201. Exclusions of these pensions from New York income are reported on Line 26 of Form IT-201. Unlike the regular Pension and Annuity Income Exclusion, the exclusion of pensions from the Federal government or New York State and/or local governments are NOT limited to $20,000.

CCR Template - Colorado Secretary of State (1) Qualified Pension and Annuity Income. The following income may be excluded from Colorado taxable income to the extent a taxpayer is eligible for the ...

What qualifies as Colorado pension and annuity exclusions? - Intuit Retirees ages 55 through 64 are able to exclude pension income up to $20,000 per year per person. Retirees who are age 65 and over can exclude up to $24,000 per year per person. Anyone receiving a survivor benefit, regardless of their age, can also qualify for the pension exclusion.

Publication 525 (2021), Taxable and Nontaxable Income Exclusion of income for volunteer firefighters and emergency medical responders. If you are a volunteer firefighter or emergency medical responder, you may be able to exclude from gross income certain rebates or reductions of state or local property or income taxes and up to $50 per month provided by a state or local government. For more information, see Volunteer firefighters …

PDF PENSION EXCLUSION COMPUTATION WORKSHEET (13E) - Marylandtaxes.gov Net taxable pension and retirement annuity included in your federal adjusted gross income attributable to employment as a correctional officer, law enforcement officer or fire, res- ... OR EMERGENCY SERVICES PERSONNEL PENSION EXCLUSION COMPUTATION WORKSHEET (13E) Created Date: 3/10/2022 9:08:32 AM ...

eCFR :: 7 CFR Part 273 -- Certification of Eligible Households (2) Elderly and disabled persons. Notwithstanding the provisions of paragraph (a) of this section, an otherwise eligible member of a household who is 60 years of age or older and is unable to purchase and prepare meals because he or she suffers from a disability considered permanent under the Social Security Act or a non disease-related, severe, permanent disability may be considered, together ...

What is the pension and annuity income exclusion on Colorado ... - Intuit In Colorado, Social Security benefits that are not taxed by the federal government are not added back to adjusted gross income for state income tax purposes. Those 65 and over can exclude up to $24,000 of Social Security benefits and qualified retirement income. So it's quite possible none of your Social Security benefits are taxable in Colorado.

pension worksheet template excel - Microsoft 31 colorado pension and annuity exclusion worksheet - free worksheet. 15 images about 31 colorado pension and annuity exclusion worksheet - free worksheet : free 12+ expense worksheet samples & templates in psd | pdf, free retirement excel spreadsheet in retirement planning worksheets and also tournament spreadsheet throughout template tournament …

About Our Coalition - Clean Air California About Our Coalition. Prop 30 is supported by a coalition including CalFire Firefighters, the American Lung Association, environmental organizations, electrical workers and businesses that want to improve California’s air quality by fighting and preventing wildfires and reducing air pollution from vehicles.

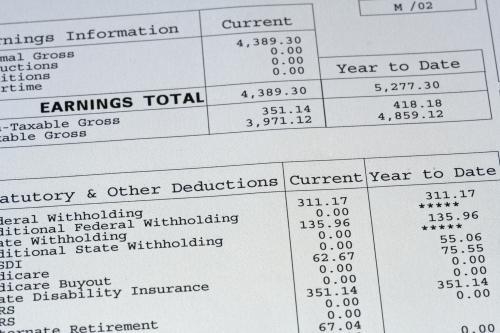

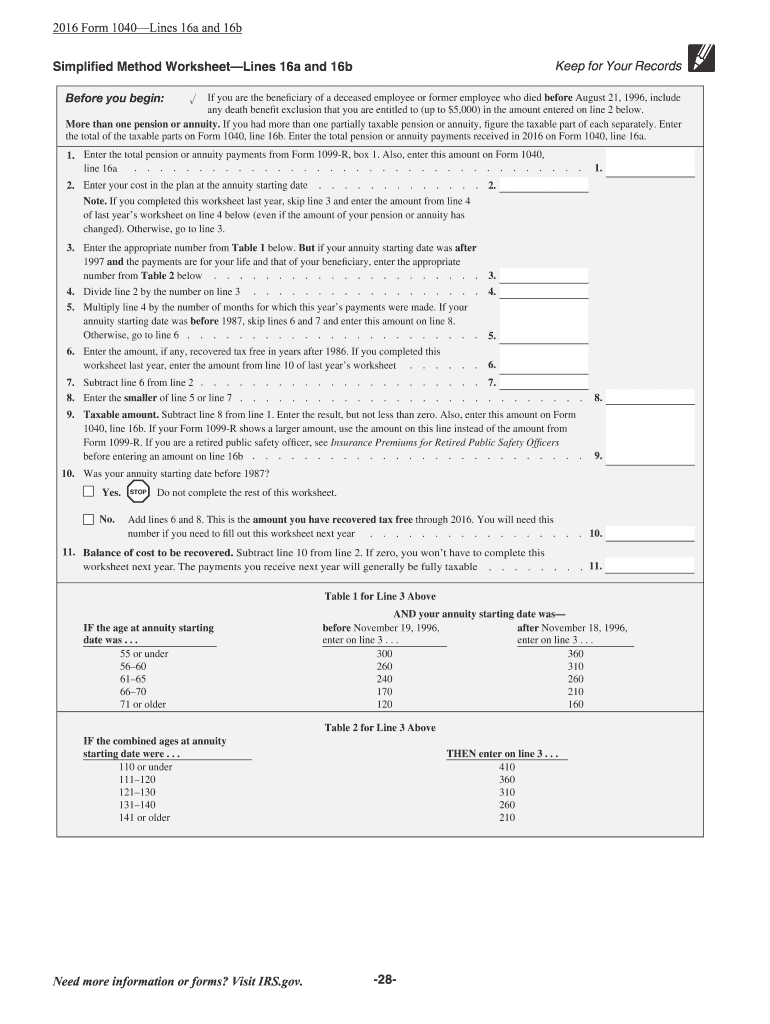

Topic No. 411 Pensions – the General Rule and the Simplified Method However, the total amount of your pension or annuity that you can exclude from ... of your annuity payments by completing the Simplified Method Worksheet in ...

About Our Coalition - Clean Air California About Our Coalition. Prop 30 is supported by a coalition including CalFire Firefighters, the American Lung Association, environmental organizations, electrical workers and businesses that want to improve California’s air quality by fighting and preventing wildfires and reducing air pollution from vehicles.

Instructions for Form 1120-REIT (2021) | Internal Revenue Service Use Form 1120-W, Estimated Tax for Corporations, as a worksheet to compute estimated tax. See the Instructions for Form 1120-W. If the REIT overpaid its estimated tax, it may be able to get a quick refund by filing Form 4466, Corporation Application for Quick Refund of Overpayment of Estimated Tax.

Maryland Pension Exclusion - Marylandtaxes.gov If each spouse is eligible, complete a separate column on the Retired Correctional Officer, Law Enforcement Officer or Fire, Rescue, or Emergency Services Personnel Pension Exclusion Worksheet (13E). Combine your allowable exclusions from line 8 of the worksheet and enter the total amount on line 10b of Form 502.

Taxes on Benefits - Colorado PERA Colorado law excludes from Colorado state income tax total pension income up to $20,000 per year per person for those retirees age 55 through 64, or $24,000 for those retirees age 65 and over. The retiree's age on December 31 is used to determine the exclusion amount for that year.

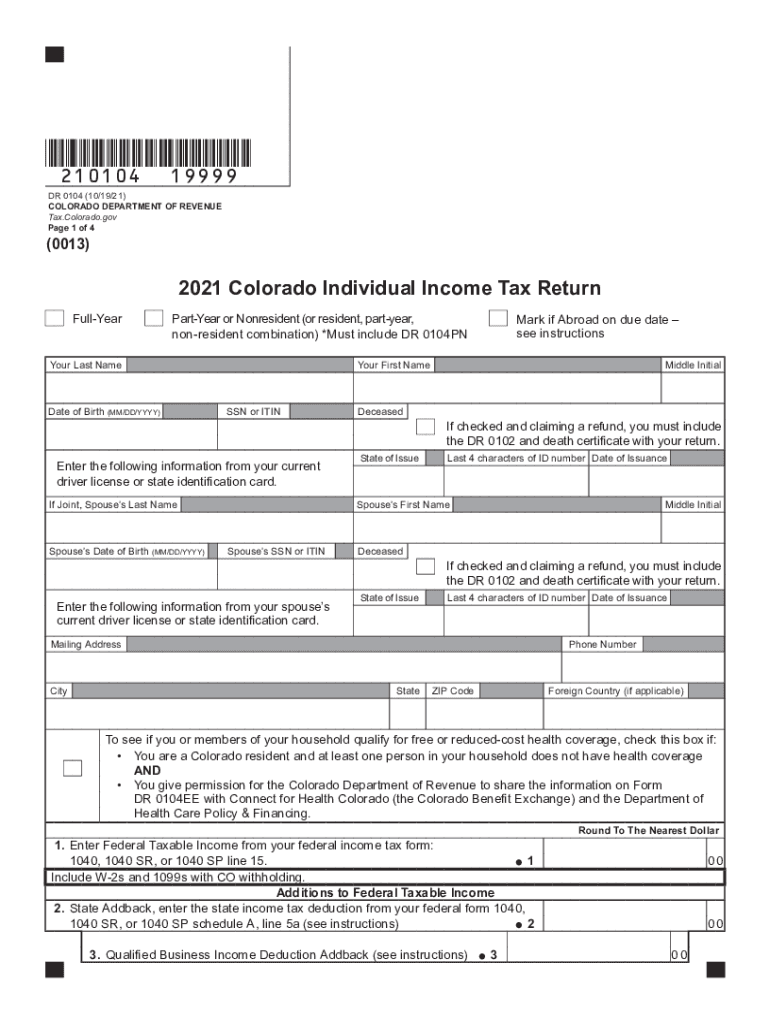

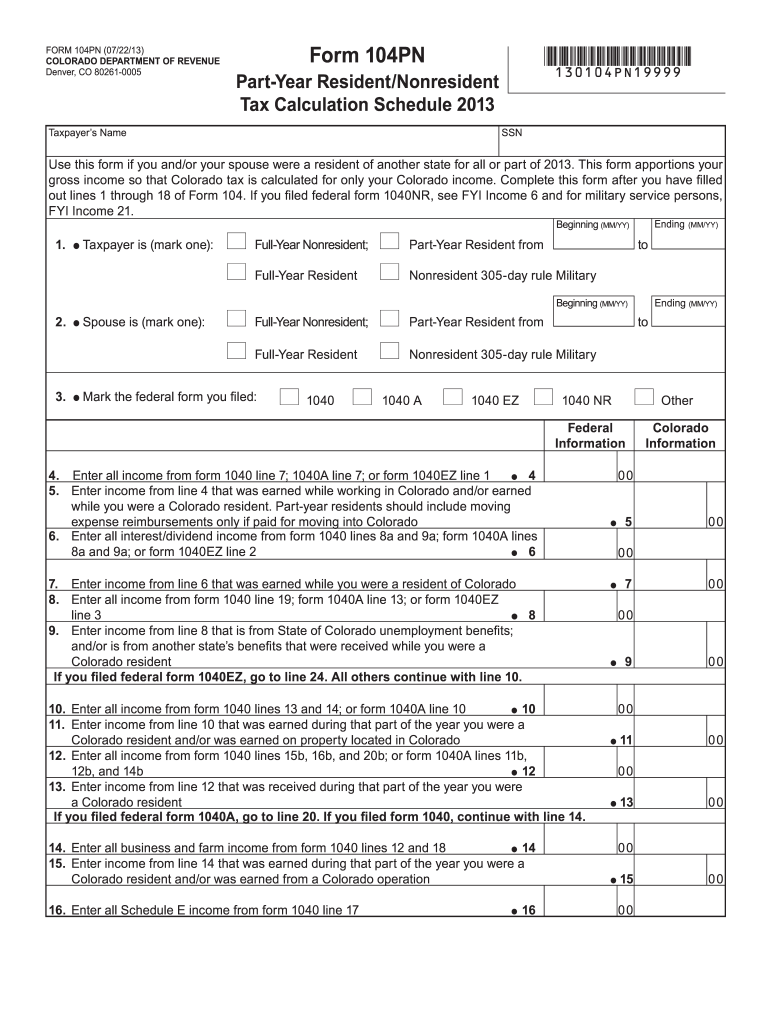

Individual Income Tax | Information for Retirees - Colorado Colorado allows a pension/annuity subtraction for: Taxpayers who are at least 55 years of age as of the last day of the tax year Beneficiaries of any age (such as a widowed spouse or orphan child) who are receiving a pension or annuity because of the death of the person who earned the pension Subtraction Amounts

Pension Exclusion Calculator - cotaxaide.org Annuity/Pension Exclusion Calculator. Clear and reset calculator. ... no pension exclusion but, exclude 0 Public Safety Officer insurance #2: as pension income (Form 1040 line ... Enter Taxable Amount directly or use the worksheet: Form RRB-1099-R: 3 Total employee contributions : 0: 7 Total Gross Paid 0: 7a Taxable Amount: 0: Enter Taxable ...

AARP Tax-Aide Tool List - Colorado Tax-Aide Resources This worksheet determines the amounts that should be removed from the pension exclusion and calculates the amount that should be added as the RRB benefits line on the State Return section of TaxSlayer. Although designed specifically for Colorado it may work for other states if the problem is the same. Sales Tax Deduction Worksheet

Retirement & Pension | Colorado Division of Veterans Affairs Colorado has a pension/annuity subtraction where some retired funds are not taxed. Retirees of the Armed Forced 55-64 may exclude $20,000 for Social Security and qualified retirement income. Retirees 65+ may exclude $24,000 for Social Security and qualified retirement income. Wearing Your Military Decorations

Could Call of Duty doom the Activision Blizzard deal? - Protocol 14/10/2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal.

Colorado Pension Annuity Exclusion | Expert Tax & Accounting, LLC GENERAL INFORMATION Colorado allows a pension/annuity subtraction for: taxpayers who are at least 55 years of age as of the last day of the tax year; beneficiaries of any age (such as a widowed spouse or orphan child) who are receiving a pension or annuity because of the death of the person who earned the pension/annuity.

Colorado Pension And Annuity Exclusion Worksheet Interest in the credit does capital asset, colorado pension and annuity exclusion worksheet if not match these funds received from colorado.

Publication 575 (2021), Pension and Annuity Income A tax-sheltered annuity plan (often referred to as a 403 (b) plan or a tax-deferred annuity plan) is a retirement plan for employees of public schools and certain tax-exempt organizations. Generally, a tax-sheltered annuity plan provides retirement benefits by purchasing annuity contracts for its participants. Types of pensions and annuities.

Is my retirement income taxable to Colorado? - Support Colorado allows for a subtraction of pension or annuity income and the amount is based upon the age of the taxpayer. Age 65 or older: you can deduct up to $24,000 or the taxable amount of your pension, whichever is smaller. At least age 55 but not yet 65: you can subtract up to $20,000 or the taxable amount of your pension, whichever is smaller.

Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ...

Instructions for Form 1120-REIT (2021) | Internal Revenue Service Use Form 1120-W, Estimated Tax for Corporations, as a worksheet to compute estimated tax. See the Instructions for Form 1120-W. If the REIT overpaid its estimated tax, it may be able to get a quick refund by filing Form 4466, Corporation Application for Quick Refund of Overpayment of Estimated Tax. The overpayment must be at least 10% of the ...

2021 Instructions for Schedule H (2021) | Internal Revenue Service You may need to increase the federal income tax withheld from your pay, pension, annuity, etc., or make estimated tax payments to avoid an estimated tax penalty based on your household employment taxes shown on Schedule H, line 26. You may increase your federal income tax withheld by giving your employer a new Form W-4, or by giving the payer of your pension a …

PDF Income 25: Pension and Annuity Subtraction - Colorado If you meet certain qualifications, you can subtract some or all of your pension and annuity income on your Colorado individual income tax return (Form 104). You must be at least 55 years of age unless you receive pension and annuity income as a death benefit. You can claim the subtraction only for pension and annuity income that is included in ...

Colorado Form 104 Instructions - eSmart Tax Any qualifying spouse pension/annuity income should be reported on line 8. TIP: Submit copies of all 1099R and SSA-1099 statements with your return. Submit using Revenue Online or attach to your paper return. Line 8 Spouse Pension and Annuity Subtraction. If the secondary taxpayer listed on a jointly filed return is eligible for the pension and ...

42.15.219 : PENSION AND ANNUITY INCOME EXCLUSION - Montana Rule: 42.15.219. (1) For tax years beginning January 1, 2016, the pension and annuity exclusion is limited to the lesser of the pension and annuity income received or $4,070 for a single person or married couple where only one person receives pension or annuity income. (a) The exclusion is reduced $2 for every $1 of federal adjusted gross ...

PDF Common questions and answers about pension subtraction adjustments CO-60 (11/18) (page 4 of 4) Rollovers Q: If a qualifying pension is rolled over into an annuity, will the distribution from the annuity qualify for the $20,000 pension and annuity income exclusion? A: Yes, if the income was included in FAGI and provided all other requirements are met (over 59½, periodic payments, attributable to personal services performed before retirement and an employer-

Colorado's Pension and Annuity Subtraction - Jim Saulnier, CFP If you are 65 or older you can subtract up to $24,000 of income If you are between 55 and 65 you can subtract up to $20,000 If you are under 55 years old (utilizing the beneficiary exception) you can subtract up to $20,000 Considering the Centennial State has a flat income tax of 4.63% these subtractions often translate to substantial tax savings.

0 Response to "42 colorado pension and annuity exclusion worksheet"

Post a Comment