45 section 125 nondiscrimination testing worksheet

PDF Section 125 Cafeteria Plans Nondiscrimination Testing Guide and ... - Basic There are nine different tests that can be applicable to benefits provided under a Section 125 plan. As noted above, some tests are related to eligibility and availability of benefits, and other tests are based on actual benefits elected (utilization). The Section 125 Cafeteria Plan 1. Eligibility Test 2. Contributions and Benefits Test 3. Popsicle Bridge - TryEngineering.org Powered by IEEE 125 meters long, and 1.8 meters wide; Designed as a curved walkway to maximize the viewing experience. Formed of steel and concrete panels set on top of an inverted triangular truss. Suspended by 8 cables from an 81.5m high single pylon, and hangs at about 100m above ground. Designed to carry a maximum capacity of 250 people. Source: Wikipedia

Microsoft takes the gloves off as it battles Sony for its Activision ... Web12/10/2022 · Microsoft is not pulling its punches with UK regulators. The software giant claims the UK CMA regulator has been listening too much to Sony’s arguments over its Activision Blizzard acquisition.

Section 125 nondiscrimination testing worksheet

PlayStation userbase "significantly larger" than Xbox even if ... Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ... Andrew File System Retirement - Technology at MSU Andrew File System (AFS) ended service on January 1, 2021. AFS was a file system and sharing platform that allowed users to access and distribute stored content. AFS was available at afs.msu.edu an… Section 125 Nondiscrimination Testing Worksheet 2022 - signNow Use a section 125 nondiscrimination testing worksheet 2022 2010 template to make your document workflow more streamlined. Get form Show details How it works Upload the section 125 plan document template Edit & sign section 125 cafeteria plan from anywhere Save your changes and share section 125

Section 125 nondiscrimination testing worksheet. PDF NONDISCRIMINATION TESTING GUIDE - amben.com nondiscrimination testing guide Source: Thomson Reuters Checkpoint (EBIA) 2 American Benefits Group • PO Box 1209, Northampton, MA 01061-1209 • Tel: 800-499-3539 • Fax: 877-723-0147 • Publication 560 (2021), Retirement Plans for Small Business WebThese limits apply for participants in SARSEPs, 401(k) plans (excluding SIMPLE plans), section 403(b) plans, and section 457(b) plans. Defined contribution limits for 2021 and 2022. The limit on contributions, other than catch-up contributions, for a participant in a defined contribution plan is $58,000 for 2021 and increases to $61,000 for 2022. Nondiscrimination Testing - American Benefits Group - amben.com Nondiscrimination Testing Guide Please complete our Nondiscrimination Testing Request Form and email it to ndx@amben.com Nondiscrimination and Taxation Considerations Account Balances & Transaction History Claims Submission Including Receipt Upload Home Participants Employers Consultants About Us Services FAQ Benefits Blog Contact Login Fire Fighter Fatality Investigation Report F2011-13 | NIOSH | CDC Mar 01, 2012 · Death in the Line of Duty…A summary of a NIOSH fire fighter fatality investigation. F2011-13 Date Released: March 1, 2012. Executive Summary. On June 02, 2011, a 48 year-old career lieutenant and a 53 year-old fire fighter/paramedic died in a multi-level residential structure fire while searching for the seat of the fire.

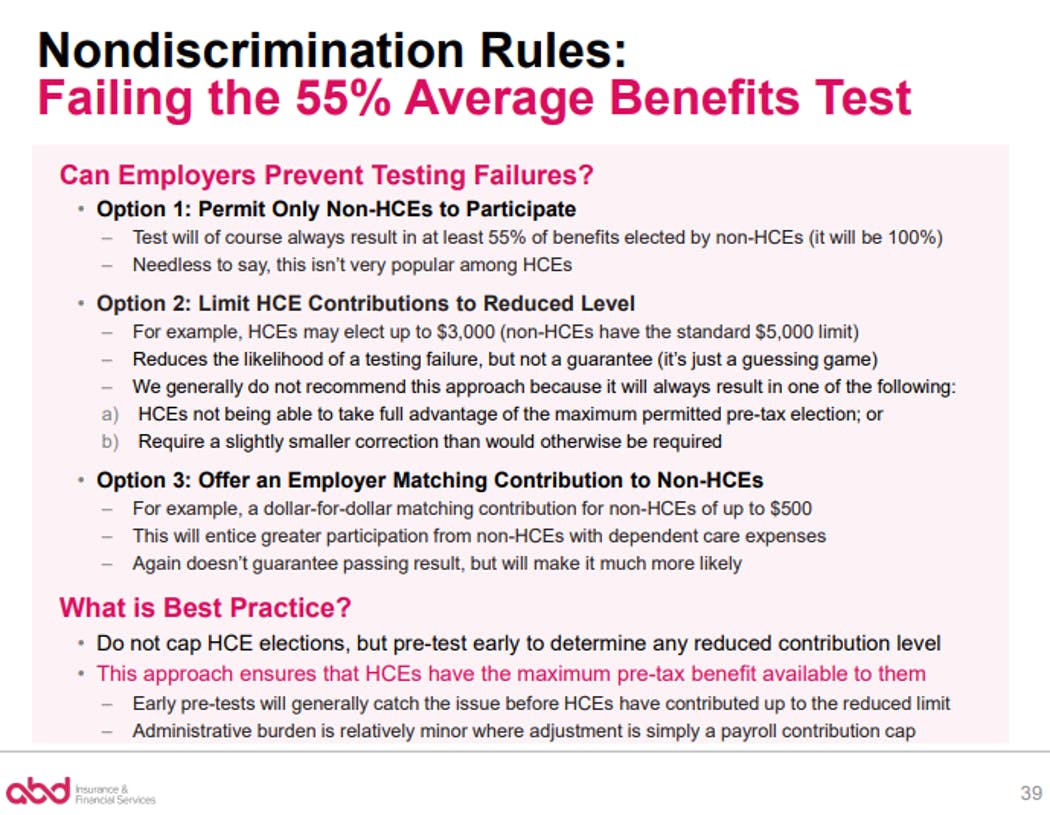

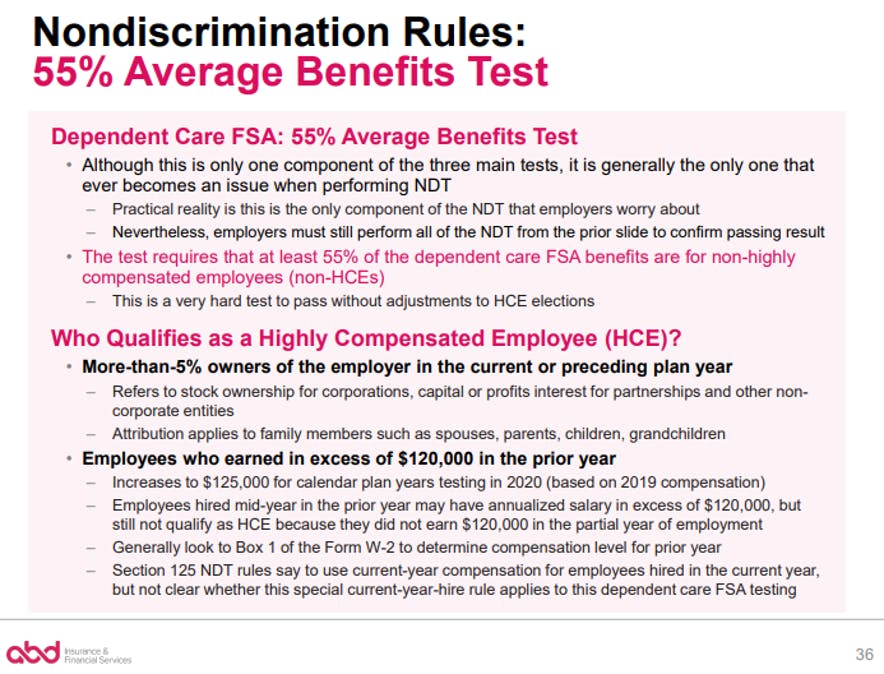

Measles - Vaccine Preventable Diseases Surveillance Manual | CDC WebSpecimens for viral isolation should be obtained in addition to serologic testing (see “Laboratory Testing” section above); isolation of wild type measles virus would allow confirmation of the case. In the absence of strain typing to confirm wild type infection, cases in persons with measles-like illness who received measles vaccine 6–45 days before … Dependent Care 55% Average Benefits Test Section 125 Nondiscrimination Testing Suite Dependent Care 55% Average Benefits Test For the purposes of the Dependent Care Test, "non-taxable benefits" is defined as all pre-tax contributions to the dependent care FSA plan. Cafeteria Plan Nondiscrimination Testing: Calculating Annual ... If you are an Employee Benefits Corporation client and completing the nondiscrimination testing worksheet, the methods above are respectively referred to as the ... PlayStation userbase "significantly larger" than Xbox even if every … Web12/10/2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ...

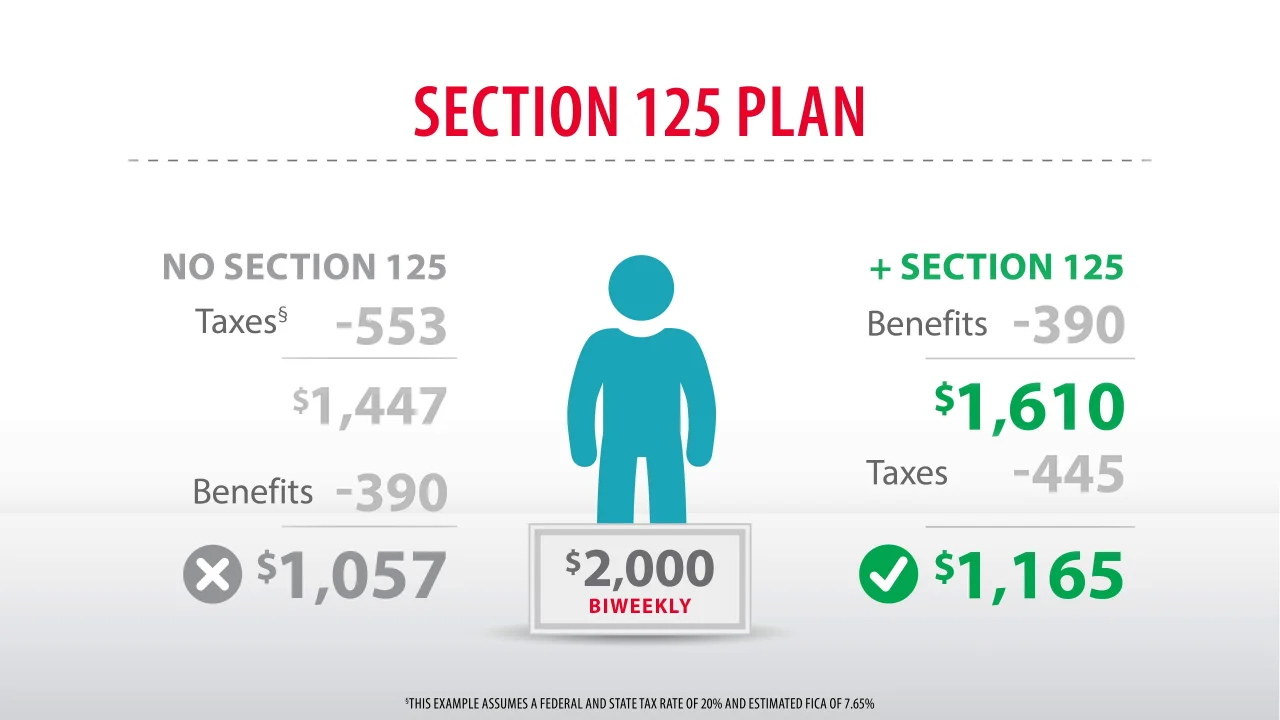

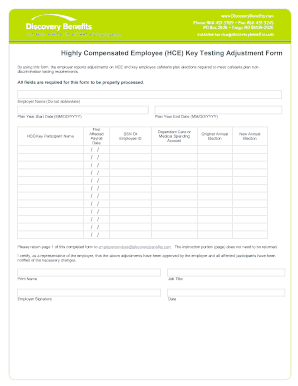

Section 125 testing: All your "w" questions answered Who is required to do this plan testing? All employers who allow for pre-tax payroll deductions for employer-sponsored health plans must do annual Section 125 nondiscrimination testing. This includes public and private companies, regardless of size, with no exceptions. If your company has a pre-tax cafeteria plan, Section 125 testing is mandatory. PDF Section 125 Flexible Benefit Plan DISCRIMINATION TESTING DATA Testing Plan Year Begin Date:_____ End Date:_____ Testing Date:_____ INSTRUCTIONS Tax savings from an IRC Section 125 Flexible Benefit Plan are available to Highly Compensated Employees and Key Employees ONLY if they are provided and utilized on a non-discriminatory basis when compared to other employees. RTO Benefits - Section 125 Testing | POP Testing | FSA Testing Non-discrimination tests ensure employers are in compliance with all regulations in order to maintain their tax-favored status. The IRS requires employers with Flexible Spending Account (FSA) plans and Premium Only Plans (POP) to submit non-discrimination tests annually. Section 125 Cafeteria Plan - POP Test. Eligibility Test Compliance Reminder for Cafeteria Plans. | WageWorks What are the Nondiscrimination Tests? The overall "25% Concentration test" compares all the pre-tax benefits elected by key employees with all the pre-tax ...

Meningitis Lab Manual: Antimicrobial Susceptibility Testing | CDC WebFootnotes. 1 Values are valid for testing this QC strain on cation-adjusted Mueller-Hinton broth (CAMHB) without blood or other supplements.. 2 Values are valid for testing this QC strain on Haemophilus test medium broth incubated in ambient air for 20-24 hr at 35°C.. 3 Values are valid for testing this QC strain on CAMHB with lysed horse blood (2.5-5.0% …

Popsicle Bridge - TryEngineering.org Powered by IEEE WebLesson focuses on how bridges are engineered to withstand weight, while being durable, and in some cases aesthetically pleasing. Students work in teams to design and build their own bridge out of up to 200 popsicle sticks and glue. Bridges must have a span of at least 14 inches and be able to hold a five pound weight (younger students) or a twenty pound …

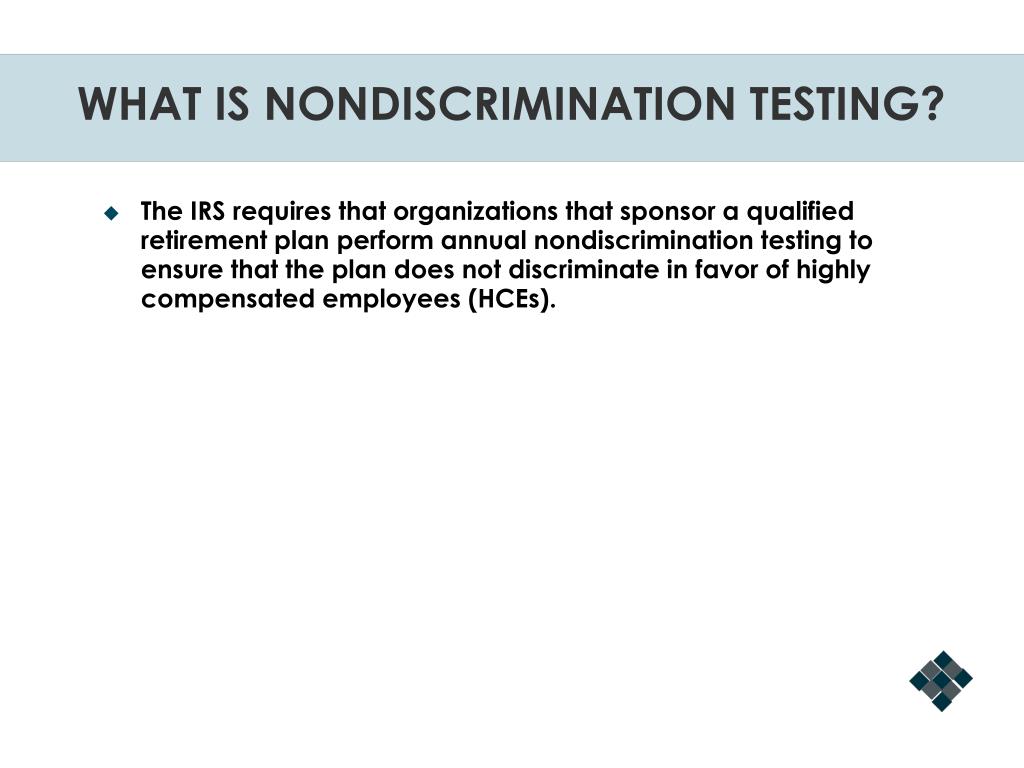

Learning About Section 125 POP Plan Nondiscrimination Testing Non-discrimination tests A Section 125 POP offered must not show any discrimination in order to be granted tax privilege status. According to the Internal Revenue Code, the plan must not discriminate in favor of "highly paid employees" (HCE) and "key employees" in terms of eligibility, contributions and benefits.

Section 125 Nondiscrimination Testing Worksheet | Learning issues ... Dec 10, 2019 - Section 125 Nondiscrimination Testing Worksheet in an understanding medium can be used to check students capabilities and understanding by answering

(WIOA) Titles I-A and I-B Policy & Procedure Manual - Wisconsin To access all Sections within a Chapter, click the plus sign (+) on the right of a Chapter title. Once you are within a Section, you can navigate to other Sections by using the slide-out Table of Contents on the upper left side of the page. Content will be added as it is approved and only Chapters and Sections with content will be clickable.

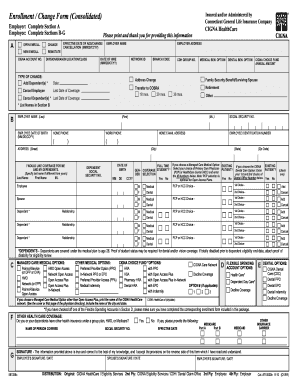

Non-discrimination testing: What you need to know | WEX Inc. The IRS requires non-discrimination testing for employers who offer plans governed by Section 125, which includes a flexible spending account (FSA). And though they aren't part of Section 125, testing is also required for health reimbursement arrangements (HRAs) and self-insured medical plans (SIMPs). Why does non-discrimination testing matter?

Nondiscrimination Testing - Section 125 | Employer Help Center Nondiscrimination Testing - Section 125 What is Section 125 Nondiscrimination Testing? Your plan allows employees to pay for their health care and dependent care expenses on a pre‐tax basis. This saves both the employer and the employee money on Income taxes and Social Security taxes.

Section 125 and 105 (h) Testing - complianceadministrators.com Section 125 testing applies to: Employers must conduct three types of non-discrimination tests every year: 1. Eligibility Test: each plan must meet three requirements. Employment Requirement: the new-hire waiting period must apply to all employees and cannot be longer than three years; Entry Requirement: employees must be eligible immediately ...

(WIOA) Titles I-A and I-B Policy & Procedure Manual - Wisconsin WebPrinting: To print, use the checkboxes in the Table of Contents to select the desired Chapter(s) or Section(s). Selected content will appear on this page, below the Table of Contents. Print the selection by using the print function of your browser. Search the WIOA Policy & Procedure Manual. Use the form field below to search the WIOA Title I-A & I-B …

PDF Nondiscrimination Testing - benstrat.com Nondiscrimination Testing In order to retain tax-favored status, the IRS Code requires that section 125, 105(h) and 129 plans pass a series of nondiscrimination test each year. The plans must not discriminate in favor of highly compensated employees (HCEs) and/or key employees with respect to the benefits provided under

Section 105(h) Nondiscrimination Rules | The Horton Group Internal Revenue Code (Code) Section 105 (h) contains nondiscrimination rules for self-insured health plans. Under these rules, self-insured health plans cannot discriminate in favor of highly compensated individuals (HCIs) with respect to eligibility or benefits. The eligibility test looks at whether a sufficient number of non-HCIs benefit ...

Nondiscrimination Testing Packages - Alerus Resource Center Nondiscrimination Testing Packages. The Internal Revenue Code requires that Section 125 and 105h benefit plans test and pass certain nondiscrimination formulas each plan year to maintain tax-preferred status and for employees to avoid income taxation on benefits. Corrections may not be made after the plan year ends to pass these tests ...

NONDISCRIMINATION TESTING GUIDE - American Benefits Group Cafeteria Plan Contributions and Benefits (C&B) Test . ... Code Section 125 nondiscrimination tests are to be performed as of the last day of the plan.

The Five Ws, and One H of Section 125 Cafeteria Plan Nondiscrimination ... Why does Section 125 cafeteria plan nondiscrimination testing matter? If audited by the IRS, an employer may need to furnish the testing results as well as any corrective action the employer took due to test failure. Failure to test may result in penalties e.g. loss of tax advantage to all participants.

Nondiscrimination Testing | Employee Welfare And Benefits | Buck This section describes the nondiscrimination tests that apply to dependent care assistance program (DCAPs), how each test operates, and what data you need to collect in order to conduct the tests. Background Section 129 of the Code provides an income tax exclusion for benefits received through an employer-sponsored DCAP.

Unbanked American households hit record low numbers in 2021 Web25/10/2022 · Those who have a checking or savings account, but also use financial alternatives like check cashing services are considered underbanked. The underbanked represented 14% of U.S. households, or 18. ...

When is Nondiscrimination Testing on a Cafeteria Plan Required ... Nondiscrimination tests on a cafeteria plan are a series of tests that are required by the Internal Revenue Service (IRS) to determine if a cafeteria plan that includes benefits like a health care flexible spending account (HCFSA), dependent care flexible spending account (DCFSA), pre-tax premiums under a cafeteria plan unjustly favor either higher-paid individuals or key employees who own or ...

section 125 nondiscrimination testing worksheet 2020 - Weebly what is section 125 nondiscrimination testing; what is section 125 discrimination testing; In this example, the cafeteria plan passes the 25% Concentration test. ... highly compensated elections in order to pass the nondiscrimination test(s), the affected ... section 125 nondiscrimination testing worksheet 2020

Publication 15-B (2022), Employer's Tax Guide to Fringe Benefits This section doesn't discuss the special valuation rule used to value meals provided at an employer-operated eating facility for employees. For that rule, see Regulations section 1.61-21(j). This section also doesn't discuss the special valuation rules used to value the use of aircraft. For those rules, see Regulations sections 1.61-21(g) and (h).

Andrew File System Retirement - Technology at MSU WebAndrew File System (AFS) ended service on January 1, 2021. AFS was a file system and sharing platform that allowed users to access and distribute stored content. AFS was available at afs.msu.edu an…

Get the free fsa nondiscrimination testing worksheet form - pdfFiller Irs Section 125 Nondiscrimination Testing Worksheet 2019 is not the form you're looking for? Search for another form here. It is estimated that about 40 percent of the employees in the United States plan to utilize self-administration and over half of the total workforce uses a TPA.

Meningitis Lab Manual: Antimicrobial Susceptibility Testing | CDC Antimicrobial susceptibility testing of S. pneumoniae This section describes the optimal media, inoculum, antimicrobial agents to test, incubation conditions, and interpretation of results for S. pneumoniae by the disk diffusion method and the antimicrobial gradient strip method. Although disk diffusion will provide information for most ...

Benefits Consulting | Cafeteria Nondiscrimination Testing | Buck The Section 125 proposed regulations state that the nondiscrimination tests must be performed as of the last day of the plan year taking into account all nonexcludable employees or former employees who were employed on any day of the plan year. But ideally, the tests would be run before, during and immediately after the close of the plan year.

How to identify key employees and HCEs for 2021 nondiscrimination testing For sponsors of Section 125 Premium Only Plans and/or Health Reimbursement Arrangements , to conduct 2021 nondiscrimination testing is not required until the end of the plan year — but it is usually a good idea for employers to conduct a sample test mid-year. That leaves time to adjust anything that might be starting to head in the wrong direction.

Section 125 Plan Nondiscrimination Testing - SIMA Financial Group Section 125 Plan Nondiscrimination Testing. A Section 125 plan, or a cafeteria plan, allows employers to provide their employees with a choice between cash.

Nondiscrimination Rules for Section 125 Plans and Self-funded ... - VCG Section 125 Plans There are three categories of nondiscrimination rules, which potentially apply to a Section 125 plan. Category 1 - Plan as a Whole. Three nondiscrimination tests apply to the plan as a whole: the eligibility test, the contributions test, and the 25% concentration test.

The Targeted Assessment for Prevention (TAP) Strategy WebTAP Glossary of Terms March 2021 [PDF – 125 KB] TAP Training – NHSN Data Entry and Analysis; Assess. TAP Facility Assessment Deployment Packet – February 2021 [PDF – 5 pages] – Resources to guide partners as they prepare to deploy TAP Facility Assessments; CAUTI TAP Facility Assessment Tool v2.0 – May 2016 [PDF – 2 MB] CLABSI TAP …

Section 125 Nondiscrimination — ComplianceDashboard: Interactive Web ... This is referred to as cafeteria plan nondiscrimination testing under section 125 of the IRS code. Plans Subject to Testing Section 125 testing must be performed on self-insured benefit programs that are paid on a pre-tax basis as a component of the cafeteria plan. This test is often performed after these programs pass 105 (h) testing.

PDF Section 125 Nondiscrimination Testing - Sentinel Benefits better benefit than other employees. All Section 125 Benefits should be included in order to carry out the testing. Please see 'About the Tests' below for more information on each test. About the Tests If you sponsor a Cafeteria/Section 125 Plan, there are three tests to complete. If you also offer Health

Section 125 Nondiscrimination Testing Suite - Sentinel Benefits Section 125 Section 125 Nondiscrimination Testing Suite What Tests Are Required? If you sponsor a Cafeteria/Section 125 Plan, there are three tests to complete. If you also offer Health Flexible Spending Account (FSA) or Dependent Care FSA benefits, there are additional tests to complete. All of the possible tests are listed below.

Section 125 Non-Discrimination Test - BBP Admin 35, Who performs the nondiscrimination testing on the cafeteria plan? ... failing all 3 tests you can review a final way to pass on our testing worksheet.

Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ...

Nondiscrimination Testing - Wrangle 5500: ERISA Reporting and Disclosure What are the tests to be conducted for Section 125, Section 129 and 105h? 4. What does each test entail? Answer: Typically, a detailed census is required to run a test, as well as a completed worksheet to provided needed plan information, such as the aggregate premium pre-tax collected for all employees vs highly compensated employees.

Section 125 Nondiscrimination Testing Worksheet 2022 - signNow Use a section 125 nondiscrimination testing worksheet 2022 2010 template to make your document workflow more streamlined. Get form Show details How it works Upload the section 125 plan document template Edit & sign section 125 cafeteria plan from anywhere Save your changes and share section 125

Andrew File System Retirement - Technology at MSU Andrew File System (AFS) ended service on January 1, 2021. AFS was a file system and sharing platform that allowed users to access and distribute stored content. AFS was available at afs.msu.edu an…

PlayStation userbase "significantly larger" than Xbox even if ... Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ...

0 Response to "45 section 125 nondiscrimination testing worksheet"

Post a Comment